A 68-year-old woman discovered her retirement savings had been decimated, leaving her with next to nothing, after her husband’s undisclosed spending habits came to light.

The woman, identified only as M. in her letter to MarketWatch’s Quentin Fottrell, revealed that her $401(k), intended to support her through retirement, had been significantly depleted by her husband’s actions, leaving her facing a precarious financial future. M., who contributed to her 401(k) for over 30 years, expressed shock and dismay upon learning the extent of the financial damage. She now faces the daunting prospect of drastically altering her retirement plans and potentially re-entering the workforce.

M.’s predicament highlights the critical importance of financial transparency and communication within marriages, especially as couples approach retirement. The situation underscores the potential for hidden financial behaviors to derail even the most carefully laid retirement plans, emphasizing the need for proactive financial management and open dialogue.

According to M.’s letter, she and her husband had separate bank accounts. While she diligently saved for retirement, her husband engaged in undisclosed spending that gradually eroded their combined financial security. The specifics of his spending habits remain vague in the original letter, but the consequences are stark: M. now faces a significantly reduced quality of life in retirement and the anxiety of potential financial instability.

“My husband and I have separate bank accounts. I’m 68, and I contributed to my 401(k) for 30-plus years,” M. wrote. “Imagine my surprise when I found out how little money there is. He has spent it. I am devastated.”

This situation serves as a cautionary tale for couples navigating retirement planning. Financial experts emphasize the importance of collaborative financial planning, shared access to financial information, and regular communication to prevent such devastating surprises. The case also raises questions about legal and ethical responsibilities within marriage regarding financial management, especially when retirement savings are involved.

The emotional toll on M. is evident in her letter. Beyond the financial implications, she now grapples with feelings of betrayal, anger, and uncertainty about her future. The incident has likely strained her relationship with her husband and forced her to reconsider her long-term plans.

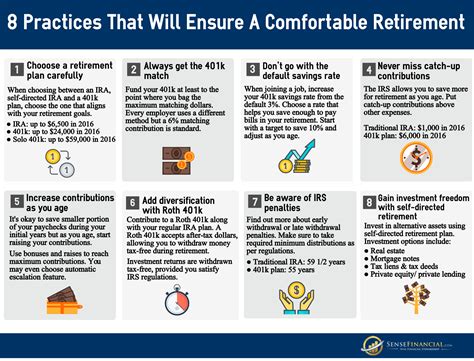

Financial advisors often recommend that couples engage in regular financial reviews, including a thorough examination of income, expenses, assets, and liabilities. These reviews can help identify potential problems early on and ensure that both partners are aware of the financial landscape. They also advise against keeping financial secrets, as these can lead to mistrust and potentially damaging consequences.

The case of M. also highlights the potential vulnerability of women in retirement, particularly those who may have relied on their husbands to manage finances. Women often live longer than men, making it crucial for them to have independent financial security and knowledge.

M.’s experience has resonated with many readers who have shared similar stories of financial betrayal or mismanagement within their marriages. It underscores the need for greater awareness and education about financial literacy and responsible financial planning, particularly for couples entering retirement.

Expanding on the Importance of Financial Transparency

Financial transparency in a marriage goes beyond simply disclosing income and expenses. It involves a shared understanding of financial goals, risk tolerance, and spending habits. It requires open communication about debts, investments, and any significant financial decisions.

When couples keep financial secrets, it creates an environment of mistrust and can lead to significant problems down the road. Hidden debts, undisclosed spending, or unilateral investment decisions can all have devastating consequences for the couple’s financial security.

In M.’s case, the lack of financial transparency allowed her husband to deplete their retirement savings without her knowledge. Had they engaged in regular financial discussions and shared access to financial accounts, she might have been able to identify the problem earlier and take steps to mitigate the damage.

The Role of Financial Advisors

Financial advisors can play a crucial role in helping couples navigate retirement planning and ensure financial transparency. They can provide objective advice on investment strategies, retirement income planning, and risk management. They can also facilitate difficult conversations about money and help couples align their financial goals.

A good financial advisor will encourage couples to share all relevant financial information and will work with them to create a comprehensive financial plan that takes into account their individual needs and goals. They can also help couples develop strategies for managing debt, saving for retirement, and protecting their assets.

Legal and Ethical Considerations

In many jurisdictions, marital assets are jointly owned, and both spouses have a legal right to access financial information. However, the legal implications of one spouse depleting marital assets without the other spouse’s knowledge can vary depending on the specific circumstances and applicable laws.

In M.’s case, she may have legal recourse against her husband for dissipating marital assets. Depending on the laws in her state, she may be able to recover some of the lost funds through a divorce settlement or other legal action.

Ethically, spouses have a responsibility to act in the best interests of their marriage and to be transparent about their finances. Hiding financial information or engaging in reckless spending can be considered a breach of trust and can have serious consequences for the relationship.

Strategies for Preventing Financial Betrayal

There are several steps that couples can take to prevent financial betrayal and ensure financial transparency in their marriage:

- Open Communication: Talk openly and honestly about money. Discuss your financial goals, risk tolerance, and spending habits.

- Shared Access to Financial Information: Ensure that both partners have access to all financial accounts and statements.

- Regular Financial Reviews: Conduct regular financial reviews to track income, expenses, assets, and liabilities.

- Joint Financial Planning: Work together to create a comprehensive financial plan that takes into account your individual needs and goals.

- Seek Professional Advice: Consult with a financial advisor to get objective advice and guidance.

- Set Spending Limits: Establish agreed-upon spending limits for individual purchases to ensure financial decisions are mutually understood and agreed upon.

- Monitor Credit Reports: Regularly check credit reports to identify any unauthorized accounts or suspicious activity.

- Discuss Large Purchases: Major financial decisions, like purchasing a vehicle or taking out a loan, should be discussed thoroughly.

- Establish Financial Ground Rules: Mutually agree upon financial practices, such as how to handle windfalls or manage debt.

- Consider a Postnuptial Agreement: While less common than prenuptial agreements, a postnuptial agreement can outline how assets will be divided in case of divorce and can provide additional financial protection.

The Emotional Impact of Financial Betrayal

Financial betrayal can have a devastating emotional impact on the victim. Beyond the financial consequences, it can lead to feelings of anger, betrayal, sadness, and loss of trust. It can also strain the relationship and lead to marital problems.

In M.’s case, the discovery of her husband’s undisclosed spending likely triggered a range of emotions, including shock, anger, and disappointment. She may also be feeling anxious about her future and uncertain about her ability to achieve her retirement goals.

Therapy or counseling can be helpful for individuals who have experienced financial betrayal. A therapist can provide support and guidance in processing the emotional impact of the betrayal and developing strategies for coping with the challenges.

Retirement Planning Considerations for Women

Women often face unique challenges when it comes to retirement planning. They tend to live longer than men, which means they need to save more for retirement. They also tend to earn less than men, which can make it more difficult to save. Additionally, women are more likely to take time out of the workforce to care for children or other family members, which can further reduce their retirement savings.

Given these challenges, it is crucial for women to take proactive steps to plan for retirement. This includes:

- Starting Early: The earlier you start saving for retirement, the more time your money has to grow.

- Saving Consistently: Even small contributions to a retirement account can add up over time.

- Investing Wisely: Consider investing in a diversified portfolio of stocks and bonds to maximize your returns.

- Seeking Professional Advice: Consult with a financial advisor to get personalized advice and guidance.

- Understanding Social Security: Familiarize yourself with Social Security benefits and how they can contribute to your retirement income.

- Planning for Healthcare Costs: Healthcare costs can be a significant expense in retirement. Plan for these costs by purchasing adequate health insurance and exploring long-term care insurance options.

- Considering Part-Time Work: Working part-time in retirement can provide additional income and help you stay active and engaged.

- Budgeting and Expense Management: Managing retirement income efficiently to cover necessary expenses can increase the longevity of savings.

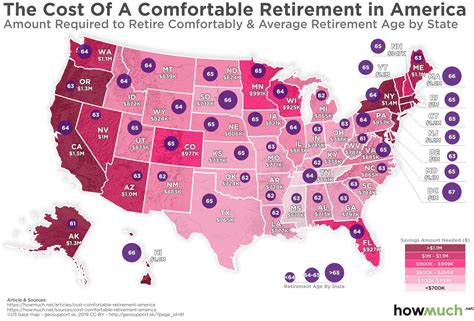

The Broader Context of Retirement Security

M.’s situation highlights a broader concern about retirement security in the United States. Many Americans are struggling to save enough for retirement, and the traditional defined-benefit pension plans are becoming increasingly rare.

As a result, individuals are increasingly responsible for managing their own retirement savings through 401(k)s and other defined-contribution plans. This requires a high degree of financial literacy and discipline, which many people lack.

Policymakers and employers need to take steps to address the retirement security crisis. This includes:

- Promoting Financial Literacy: Providing financial education to help people make informed decisions about saving and investing.

- Strengthening Social Security: Ensuring that Social Security remains a viable source of retirement income for future generations.

- Expanding Access to Retirement Savings Plans: Making it easier for workers to save for retirement through employer-sponsored plans.

- Protecting Retirement Savings: Implementing regulations to protect retirement savings from fraud and mismanagement.

- Encouraging Employers to Offer Retirement Plans: Incentivizing companies to provide retirement plans with matching contributions to boost employee savings.

Alternative Living Solutions During Retirement

With retirement savings significantly impacted, retirees may need to consider alternative living arrangements. Downsizing to a smaller home, moving to a more affordable location, or exploring co-housing communities can reduce living expenses. Some retirees also choose to rent out a room in their home or participate in home-sharing programs to generate income.

Navigating Senior Benefits and Programs

Seniors in financial distress should explore available government and community programs designed to provide support. Social Security benefits, Medicare, Medicaid, and Supplemental Security Income (SSI) can offer crucial assistance. Additionally, many local and national organizations offer services such as food assistance, housing assistance, and help with utility bills.

The Importance of Estate Planning

Even with diminished retirement savings, estate planning remains essential. A will or trust ensures that assets are distributed according to one’s wishes and can minimize potential legal complications for loved ones. Consulting with an estate planning attorney can help navigate complex issues and ensure that the plan aligns with individual circumstances.

Impact of Inflation on Retirement Savings

The erosive effect of inflation on retirement savings is a significant concern. Inflation reduces the purchasing power of savings, making it harder to afford necessities. Retirees need to factor inflation into their retirement plans and consider investments that can outpace inflation, such as stocks or inflation-protected securities.

Seeking Support Groups and Counseling

Dealing with financial hardship in retirement can be emotionally challenging. Support groups and counseling services offer a safe space to share experiences, gain emotional support, and learn coping strategies. Connecting with others facing similar challenges can reduce feelings of isolation and provide valuable insights.

Understanding Investment Options for Retirement

Retirees must understand the various investment options available to them. While risk tolerance typically decreases in retirement, some exposure to growth assets, such as stocks, can help maintain purchasing power and generate income. Bonds, annuities, and real estate investments can also play a role in a diversified retirement portfolio.

The Role of Long-Term Care Insurance

Long-term care expenses can quickly deplete retirement savings. Long-term care insurance can help cover the costs of assisted living, nursing home care, or in-home care. While premiums can be expensive, long-term care insurance can provide financial protection and peace of mind.

Strategies for Generating Income in Retirement

Retirees can explore various strategies for generating income in retirement. Part-time work, consulting, freelancing, and rental income can supplement retirement savings. Additionally, strategies such as reverse mortgages or selling assets can provide additional income streams.

Building a Strong Social Network

A strong social network can enhance the quality of life in retirement and provide emotional support during challenging times. Staying connected with friends and family, joining community groups, and volunteering can combat loneliness and promote well-being.

Adapting to a Reduced Retirement Lifestyle

Adjusting to a reduced retirement lifestyle requires flexibility and adaptability. Prioritizing essential expenses, cutting back on discretionary spending, and finding affordable leisure activities can help make the most of limited resources. A positive mindset and a willingness to embrace change can make the transition smoother.

Key Takeaways for Retirement Planning

Several key takeaways can help individuals plan for a secure retirement:

- Start saving early and consistently.

- Create a comprehensive financial plan.

- Understand your risk tolerance.

- Diversify your investments.

- Monitor your progress regularly.

- Seek professional advice when needed.

- Maintain open communication with your spouse or partner.

- Be prepared for unexpected expenses.

- Plan for healthcare costs.

- Stay informed about financial matters.

By following these principles, individuals can increase their chances of enjoying a comfortable and fulfilling retirement, even in the face of unexpected challenges.

Frequently Asked Questions (FAQ)

-

What are the key warning signs of financial infidelity in a marriage?

Key warning signs include secretive behavior around finances, undisclosed bank accounts or credit cards, unexplained withdrawals or expenses, reluctance to discuss money matters, and a significant change in spending habits without explanation. As financial advisor Mari Adam notes, “One of the biggest mistakes I see is not having both spouses involved in the money decisions.”

-

What legal recourse does a spouse have if their partner secretly depletes retirement savings?

The legal recourse available depends on state laws. Options may include seeking compensation through a divorce settlement, pursuing a claim for breach of fiduciary duty, or filing a civil lawsuit for financial mismanagement. Consulting with a family law attorney is crucial to understand specific rights and options. “Depending on the laws in her state, she may be able to recover some of the lost funds through a divorce settlement or other legal action,” notes a legal expert.

-

How can couples prevent similar situations of financial mismanagement from occurring in their relationship?

Prevention strategies include establishing open and honest communication about finances, creating a joint budget, sharing access to financial accounts and statements, conducting regular financial reviews, setting spending limits, and seeking professional financial advice. Experts suggest, “Couples should engage in regular financial reviews, including a thorough examination of income, expenses, assets, and liabilities,” to mitigate future damages.

-

What immediate steps should someone take if they discover their retirement savings have been secretly depleted by their spouse?

Immediate steps include gathering all relevant financial documents, consulting with a financial advisor and an attorney, assessing the extent of the damage, and developing a plan to address the financial shortfall. It is also crucial to prioritize mental health and seek support from friends, family, or a therapist.

-

What resources are available for individuals who are facing financial hardship in retirement due to mismanagement of funds?

Available resources include government assistance programs such as Social Security, Medicare, and Medicaid, as well as non-profit organizations that provide financial counseling, housing assistance, and food assistance. Additionally, support groups and counseling services can offer emotional support and guidance.