A 68-year-old woman discovered her husband’s secret spending habits depleted their 401(k), leaving her with minimal retirement savings and facing significant financial insecurity.

A woman, identified as M. in a recent MarketWatch article, is grappling with the stark reality of a severely diminished 401(k) after uncovering her husband’s undisclosed spending habits. At 68, M. faces a precarious financial future, having believed she was secure in retirement. The discovery has not only jeopardized her financial stability but also strained her marriage, forcing her to confront difficult decisions about her future.

According to M., her husband handled the finances throughout their marriage. She trusted him implicitly, a trust that has now been severely shaken. “I am 68 and discovered that my husband has been secretly spending money, and now my 401(k) is almost gone,” she lamented in a letter to MarketWatch’s personal finance columnist, Quentin Fottrell. The exact amount of money spent remains undisclosed, but the impact is undeniable: M. now describes herself as being left with “pennies.”

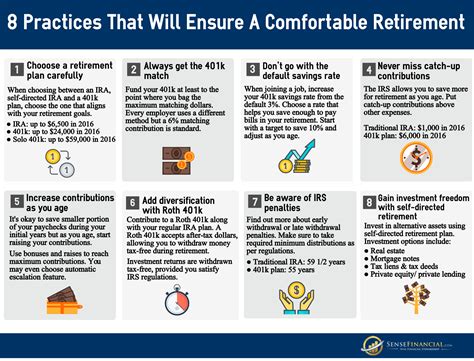

The situation underscores the importance of transparency and open communication within a marriage, particularly when it comes to financial matters. Experts caution against relinquishing all financial control to one partner, regardless of the level of trust. This case serves as a cautionary tale, highlighting the potential consequences of financial secrecy and the devastating impact it can have on retirement plans.

M.’s immediate concern is how to secure her financial future. She is exploring various options, including downsizing, seeking employment, and potentially delaying retirement indefinitely. The emotional toll of this discovery is significant, as she grapples with feelings of betrayal, anxiety, and uncertainty. “I don’t know what to do,” she confessed, reflecting the profound sense of helplessness many individuals face when confronted with unexpected financial hardship.

Financial advisors emphasize the need for couples to engage in regular financial discussions, review investment statements jointly, and establish clear spending guidelines. This proactive approach can help prevent similar situations from arising and ensure both partners are informed and involved in managing their financial future. The case also highlights the importance of seeking professional financial advice, particularly when facing complex financial decisions or navigating a financial crisis.

M.’s story has resonated with many readers, sparking a broader conversation about financial transparency, marital trust, and retirement planning. It serves as a stark reminder of the importance of proactive financial management and the potential pitfalls of financial secrecy. The situation underscores the need for couples to work together to build a secure financial future, based on open communication, mutual understanding, and shared responsibility.

Many financial experts suggest that even in the most trusting relationships, some level of oversight is beneficial. This doesn’t necessarily mean micromanaging every expense, but rather establishing a system where both partners have access to financial information and participate in major financial decisions. This can involve setting up joint accounts, reviewing bank statements together, and regularly discussing financial goals and concerns.

The consequences of M.’s husband’s actions extend beyond the immediate financial impact. The erosion of trust can have long-lasting effects on the marital relationship, leading to resentment, conflict, and even separation. Rebuilding trust after such a betrayal requires open communication, honesty, and a willingness to address the underlying issues that contributed to the financial secrecy.

For individuals facing similar situations, it’s crucial to seek professional help, both financial and emotional. A financial advisor can help assess the damage, develop a plan to mitigate the losses, and provide guidance on how to rebuild financial security. A therapist or counselor can provide support and guidance in navigating the emotional challenges associated with financial betrayal and marital conflict.

M.’s case is not unique. Many individuals and couples face unexpected financial challenges that can derail their retirement plans. However, with proactive planning, open communication, and a willingness to seek help when needed, it is possible to navigate these challenges and secure a more stable financial future. The key is to take control of the situation, learn from past mistakes, and work towards building a stronger, more transparent financial partnership.

The situation M. is facing also highlights the need for greater financial literacy, especially among women. Historically, women have often been excluded from financial decision-making, leaving them vulnerable to financial mismanagement or abuse. Empowering women with the knowledge and skills to manage their finances is crucial for ensuring their financial independence and security.

M.’s story is a poignant reminder that financial security is not guaranteed, even in long-term relationships. It underscores the importance of proactive financial management, open communication, and a willingness to seek help when needed. By learning from M.’s experience, individuals and couples can take steps to protect their financial future and build a more secure retirement. The narrative emphasizes the need to question, verify and be part of the financial decision making process for every couple, regardless of their perceived strengths and weaknesses in certain fields.

The lack of detail regarding the types of expenditures made by M’s husband also creates a sense of unease. Was it gambling? Lavish gifts? Poor investments? The ambiguity contributes to the gravity of the story, suggesting a level of deception that goes beyond simple overspending. Regardless, the secrecy surrounding the spending is as damaging as the spending itself.

The article further illustrates the vulnerability of older adults to financial exploitation. While M.’s situation involves a spouse, elder financial abuse can also come from family members, caregivers, or even strangers. It’s crucial for older adults to be aware of the risks and take steps to protect themselves from financial scams and exploitation. This includes staying informed about common scams, being cautious about sharing personal information, and seeking help from trusted sources if they suspect they are being targeted.

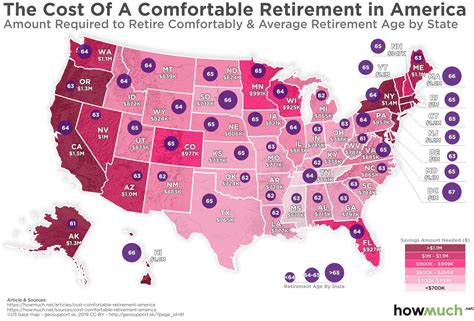

M.’s age, 68, adds another layer of complexity to her situation. Re-entering the workforce at that age can be challenging, and finding a job that pays enough to cover her expenses may be difficult. She may also face age discrimination in the hiring process. However, with the right skills and resources, it is possible to find meaningful employment and supplement her retirement income.

The financial stress M. is experiencing can also have a negative impact on her physical and mental health. Stress can lead to a variety of health problems, including anxiety, depression, and heart disease. It’s important for M. to prioritize her well-being and seek professional help if she is struggling to cope with the stress.

Downsizing, which M. is considering, can be a viable option for reducing expenses and freeing up cash. However, it’s important to carefully consider the costs and benefits of downsizing before making a decision. This includes evaluating the emotional impact of leaving a familiar home and neighborhood, as well as the financial costs of moving and setting up a new household.

Another option for M. is to explore government assistance programs. Depending on her income and assets, she may be eligible for programs such as Social Security, Medicare, and Medicaid. These programs can provide essential financial and healthcare support during retirement.

The article also touches upon the importance of estate planning. A well-crafted estate plan can help protect assets and ensure that they are distributed according to one’s wishes. It’s important for couples to review their estate plan regularly and make sure it reflects their current circumstances and goals. This is especially important in situations where there has been a significant change in financial circumstances, such as the loss of retirement savings.

M.’s story serves as a strong cautionary message for not only couples, but individuals as well. Maintaining control of your finances, being educated about the current standing of your assets, and making informed financial decisions are all important steps to securing your financial future. It’s also a lesson in the importance of honest communication and trust between partners, as well as the need to be prepared for unexpected financial challenges.

The details in M’s story are vague, and while this might be to protect her identity, it also serves to highlight that this is a common issue that many people deal with and are ashamed of. The financial difficulties couples face are often not spoken about and kept secret because of the shame that is associated with them. This leads to people feeling isolated and without support.

In addition to the practical steps M. can take to improve her financial situation, it’s also important for her to focus on her emotional well-being. This includes seeking support from friends and family, engaging in activities that bring her joy, and practicing self-care. Maintaining a positive outlook and a strong support system can help her navigate the challenges ahead and rebuild her life.

M.’s story, while disheartening, can serve as a catalyst for positive change. By sharing her experience, she is raising awareness about the importance of financial transparency and empowering others to take control of their financial future. Her story is a reminder that even in the face of adversity, it is possible to rebuild and create a more secure and fulfilling life.

The original article also alludes to a potential power imbalance in the relationship. M. trusted her husband to handle the finances, perhaps due to societal expectations or a lack of financial literacy on her part. This imbalance of power can create an environment where financial abuse can thrive. It’s important for both partners to have equal access to financial information and to participate in financial decision-making.

Moreover, the article implicitly critiques the societal norms that often assign financial management to one partner in a marriage. This outdated model can leave the other partner vulnerable and unprepared to handle financial matters in the event of divorce, death, or, as in M.’s case, financial mismanagement. A more equitable approach involves shared responsibility and mutual understanding of the couple’s financial situation.

The article also implies the importance of having an emergency fund. While M. had a 401(k), it appears that she did not have a separate emergency fund to cover unexpected expenses. An emergency fund can provide a financial cushion in times of crisis, such as job loss, medical bills, or, in this case, the depletion of retirement savings. Financial advisors typically recommend having three to six months’ worth of living expenses in an emergency fund.

M.’s story also prompts a reflection on the role of financial institutions in protecting consumers from financial abuse. While banks and investment firms have a responsibility to safeguard their clients’ assets, they may not always be able to detect or prevent financial mismanagement within a marriage. It’s important for individuals to be vigilant about monitoring their accounts and reporting any suspicious activity.

The lack of legal recourse for M. is another concerning aspect of this story. Depending on the laws in her state, she may have limited options for recovering the lost funds from her husband. This highlights the need for stronger legal protections for individuals who are victims of financial abuse within a marriage.

The article also indirectly raises questions about the effectiveness of financial education programs. While many people receive some form of financial education during their lifetime, it may not be sufficient to prepare them for the complexities of managing finances in a long-term relationship. More comprehensive and accessible financial education programs are needed to empower individuals to make informed financial decisions and protect themselves from financial abuse.

M.’s situation also underscores the importance of seeking professional help early on. Had she sought financial advice earlier in her marriage, she may have been able to detect her husband’s spending habits and prevent the depletion of her 401(k). It’s always better to be proactive about financial planning than to wait until a crisis occurs.

The article serves as a reminder that financial security is a lifelong process, not a one-time achievement. It requires ongoing planning, monitoring, and adaptation to changing circumstances. By staying informed, seeking professional advice, and communicating openly with their partners, individuals can increase their chances of achieving financial security and enjoying a comfortable retirement.

M.’s story also speaks to the broader issue of retirement insecurity in the United States. Many Americans are struggling to save enough for retirement, due to factors such as low wages, rising healthcare costs, and inadequate access to retirement savings plans. M.’s experience highlights the vulnerability of older adults who have not adequately prepared for retirement and the need for policies that promote retirement security.

The concluding lesson from M’s unfortunate experience is the critical need for shared financial knowledge and active participation in financial management within a marriage. It is a call for transparency, continuous learning, and proactive measures to protect against unforeseen financial pitfalls. This situation demonstrates that trust, while essential in a relationship, should be complemented by informed oversight to ensure a secure and equitable financial future for both partners.

Frequently Asked Questions (FAQ)

1. What exactly happened in M.’s situation?

M., a 68-year-old woman, discovered that her husband had been secretly spending money, significantly depleting their 401(k) retirement savings. She was unaware of these expenditures and now faces financial insecurity in her retirement. As she states, she is now left with “pennies”.

2. What are some of the potential reasons for the husband’s secret spending?

The article does not specify the reasons for the husband’s secret spending. However, possibilities could include gambling addiction, poor investment decisions, lavish spending habits, or attempts to conceal financial problems. Without further details, the exact cause remains unknown.

3. What steps can M. take to improve her financial situation?

According to the source material, M. is considering downsizing her home and seeking employment. She should also consult with a financial advisor to assess the extent of the financial damage and develop a plan for rebuilding her retirement savings. Exploring government assistance programs is also recommended. Legal options may exist to recover some of the funds, depending on her state’s laws, and she should seek legal counsel.

4. What are the key takeaways or lessons from this story?

The primary lessons include the importance of financial transparency and open communication in a marriage. Couples should jointly manage their finances, regularly review investment statements, and establish clear spending guidelines. It also highlights the need for financial literacy, especially for women, and the importance of having an emergency fund to cope with unexpected financial crises.

5. How can couples prevent similar situations from happening in their relationships?

Couples can prevent similar situations by engaging in regular financial discussions, creating a joint budget, and maintaining shared access to all financial accounts. They should also seek professional financial advice and be proactive about monitoring their investments. Building a relationship based on trust and honesty, including financial matters, is crucial. It is equally important that both partners are involved in the financial decisions making process and feel comfortable questioning or suggesting alternative paths.