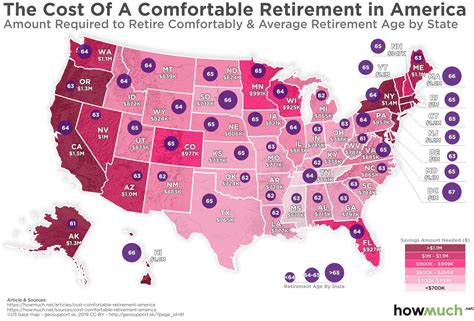

A comfortable retirement now requires a staggering $1.46 million, according to Northwestern Mutual’s 2024 Planning & Progress Study, but the vast majority of Americans are falling far short of this goal, with average retirement savings lagging significantly behind.

The study reveals a stark disparity between the ever-increasing target for a financially secure retirement and the reality of most Americans’ savings. Northwestern Mutual’s annual study, which surveyed over 4,500 U.S. adults, found the magic number for a comfortable retirement jumped 15% from the $1.27 million target reported in 2023, and a whopping 53% since 2020 when it was $951,000. Despite this escalating benchmark, the average retirement savings among Americans is only $88,400, a figure that underscores the immense challenge many face in achieving their retirement aspirations.

“There’s a growing gap between what people think they’ll need to retire comfortably and what they’ve actually saved, and that gap is widening,” said Aditi Javeri Gokhale, chief strategy officer at Northwestern Mutual.

The Widening Retirement Savings Gap

The chasm between the ideal retirement nest egg and the actual savings of Americans highlights a growing crisis. While the $1.46 million target might seem unattainable for many, the reality is even more concerning when considering the average retirement savings. The $88,400 figure represents the median retirement savings across all age groups and income levels. However, it’s crucial to recognize the distribution of these savings.

Many Americans have significantly less than the average, particularly those nearing retirement age who haven’t adequately prepared. Younger generations face different challenges, including student loan debt, rising living costs, and stagnant wages, making it difficult to prioritize retirement savings early in their careers.

The study also revealed that Americans believe they need $65,000 per year to live comfortably in retirement. However, with inflation continuing to impact the cost of goods and services, this figure may prove to be insufficient. The rising cost of healthcare, housing, and other essential expenses could further strain retirement savings, requiring retirees to either reduce their standard of living or draw down their savings more quickly than anticipated.

Factors Contributing to the Retirement Savings Shortfall

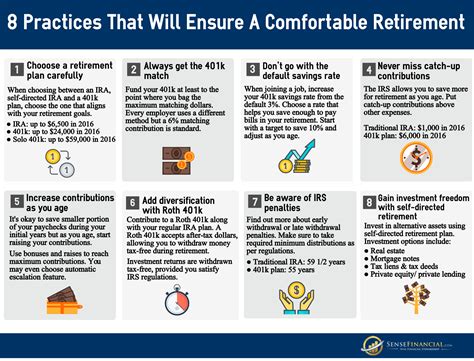

Several factors contribute to the widespread retirement savings shortfall. One of the most significant is the lack of financial literacy and planning. Many Americans lack a clear understanding of how to save and invest for retirement effectively. They may not be aware of the various retirement savings options available, such as 401(k)s, IRAs, and Roth IRAs, or they may not know how to allocate their investments to maximize returns while managing risk.

Another contributing factor is the decline of traditional pension plans. In the past, many employers offered defined-benefit pension plans that guaranteed a certain level of income in retirement. However, these plans have largely been replaced by defined-contribution plans, such as 401(k)s, which place the responsibility of saving and investing for retirement squarely on the shoulders of the employee. While 401(k)s can be a valuable tool for retirement savings, they require employees to actively participate and make informed investment decisions.

Wage stagnation and rising costs of living also play a significant role. Many Americans have seen their wages stagnate or decline in real terms over the past few decades, while the cost of housing, healthcare, education, and other essential expenses has continued to rise. This makes it difficult for people to save for retirement, especially those with low or moderate incomes.

Furthermore, unexpected financial emergencies can derail retirement savings plans. Medical bills, job loss, or other unforeseen events can force people to dip into their retirement savings, making it even harder to reach their goals.

Impact of Inflation

Inflation is a key driver behind the surging retirement target. The higher cost of goods and services erodes the purchasing power of savings, requiring individuals to accumulate more money to maintain the same standard of living in retirement. With inflation rates fluctuating, predicting future expenses becomes even more challenging.

The Consumer Price Index (CPI), a key measure of inflation, has shown considerable volatility in recent years. While inflation has cooled down from its peak in 2022, it remains above the Federal Reserve’s target of 2%. This persistent inflation is forcing Americans to re-evaluate their retirement plans and consider strategies to protect their savings from the eroding effects of rising prices.

One strategy is to invest in assets that tend to perform well during inflationary periods, such as real estate, commodities, and inflation-protected securities. However, these investments also come with risks, and it’s important to carefully consider your risk tolerance and investment horizon before making any changes to your portfolio.

Generational Differences in Retirement Preparedness

The Northwestern Mutual study also highlights significant generational differences in retirement preparedness. Older generations, such as Baby Boomers and Generation X, are generally closer to retirement age and have had more time to accumulate savings. However, many of them still face challenges in reaching their retirement goals, particularly if they experienced financial setbacks or didn’t start saving early enough.

Younger generations, such as Millennials and Generation Z, have the advantage of time on their side, but they also face unique challenges, including student loan debt, rising housing costs, and uncertainty about the future of Social Security. Many young people are delaying marriage, homeownership, and starting families, which can further impact their ability to save for retirement.

“Younger generations are entering the workforce with significant financial burdens, making it harder to prioritize retirement savings,” said Gokhale. “They need to start saving early and take advantage of compounding returns to build a secure financial future.”

Strategies for Improving Retirement Savings

Despite the challenges, there are several strategies that Americans can use to improve their retirement savings prospects:

- Start Saving Early: The earlier you start saving for retirement, the more time your money has to grow through the power of compounding. Even small contributions made early in your career can make a big difference over time.

- Set Realistic Goals: Determine how much you need to save for retirement based on your individual circumstances and goals. Consider factors such as your current income, expenses, desired lifestyle in retirement, and expected retirement age.

- Take Advantage of Employer-Sponsored Retirement Plans: If your employer offers a 401(k) or other retirement savings plan, take advantage of it. Contribute enough to receive the full employer match, if available. This is essentially free money that can significantly boost your retirement savings.

- Consider Opening an IRA: If you don’t have access to an employer-sponsored retirement plan, or if you want to supplement your existing savings, consider opening an Individual Retirement Account (IRA). There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, and real estate. This can help reduce risk and improve your overall returns.

- Rebalance Your Portfolio Regularly: As you get closer to retirement, you may want to gradually shift your portfolio away from stocks and towards more conservative investments, such as bonds. This can help protect your savings from market volatility.

- Seek Professional Financial Advice: If you’re unsure how to save and invest for retirement, consider seeking professional financial advice. A qualified financial advisor can help you develop a personalized retirement plan based on your individual needs and goals.

- Automate Your Savings: Set up automatic transfers from your checking account to your retirement savings account each month. This makes saving effortless and ensures that you’re consistently contributing to your retirement goals.

- Reduce Debt: High levels of debt can make it difficult to save for retirement. Prioritize paying off high-interest debt, such as credit card debt, as quickly as possible.

- Cut Expenses: Identify areas where you can cut back on your spending and redirect those savings towards retirement. Even small changes, such as packing your lunch instead of eating out, can add up over time.

- Work Longer: Delaying retirement by even a few years can have a significant impact on your retirement savings. It allows you to continue earning income, contributing to your retirement accounts, and delaying withdrawals.

- Consider a Part-Time Job in Retirement: Working part-time in retirement can provide additional income and help you stretch your savings further. It can also help you stay active and engaged in retirement.

- Plan for Healthcare Costs: Healthcare costs are a significant expense in retirement. Make sure you have adequate health insurance coverage and consider saving for long-term care expenses.

- Review Your Retirement Plan Regularly: Your retirement plan should be a living document that you review and update regularly. As your circumstances change, you may need to adjust your savings goals, investment strategy, or retirement age.

The Role of Social Security

Social Security plays a crucial role in providing retirement income for many Americans. However, the future of Social Security is uncertain. The Social Security Administration projects that the Social Security trust funds will be depleted in the coming years, which could lead to benefit cuts.

While Congress is likely to take action to address the Social Security shortfall, it’s important to plan for the possibility of reduced benefits. Consider delaying retirement to increase your Social Security benefits or saving more on your own to supplement your Social Security income.

The Importance of Financial Literacy

Financial literacy is essential for making informed decisions about saving and investing for retirement. Many Americans lack the knowledge and skills necessary to manage their finances effectively. Financial literacy education should be a priority in schools and workplaces.

There are many resources available to help people improve their financial literacy, including online courses, workshops, and books. Take the time to educate yourself about personal finance and develop a plan for achieving your financial goals.

The Impact of the Pandemic

The COVID-19 pandemic had a significant impact on the retirement savings of many Americans. Millions of people lost their jobs or experienced reduced incomes, forcing them to dip into their retirement savings to make ends meet.

The pandemic also highlighted the importance of having an emergency fund to cover unexpected expenses. Many people realized that they were not adequately prepared for a financial crisis.

As the economy recovers from the pandemic, it’s important to rebuild your retirement savings and ensure that you have a financial safety net in place.

Government Initiatives and Policies

The government plays a role in promoting retirement savings through various initiatives and policies. These include tax incentives for retirement savings, such as the Saver’s Credit, and regulations governing employer-sponsored retirement plans.

The government also provides resources and information to help people plan for retirement, such as the Social Security Administration’s website.

Policymakers are continually exploring ways to improve the retirement security of Americans, such as expanding access to retirement savings plans and strengthening Social Security.

The Future of Retirement

The future of retirement is uncertain, but it’s clear that Americans need to take proactive steps to prepare for their financial future. The traditional model of retirement, where people work for 30 or 40 years and then retire comfortably on their savings and Social Security, is becoming increasingly unrealistic.

Many people will need to work longer, save more, and be more flexible in their retirement plans. They may also need to consider alternative sources of income, such as part-time work or starting a business.

The key to a successful retirement is to plan ahead, save diligently, and stay informed about your financial options.

Conclusion

The Northwestern Mutual study paints a sobering picture of the retirement landscape in America. The ever-increasing target for a comfortable retirement, coupled with the relatively low savings of many Americans, underscores the challenges facing individuals as they plan for their financial future. Addressing this issue requires a multi-faceted approach, including improved financial literacy, increased savings rates, and sound investment strategies. It also necessitates a broader societal conversation about the future of retirement and the policies needed to ensure that all Americans have the opportunity to retire with dignity and security. The data serves as a call to action for individuals, employers, and policymakers to prioritize retirement planning and take steps to close the retirement savings gap. Ignoring this growing crisis will have far-reaching consequences for individuals, families, and the economy as a whole.

Frequently Asked Questions (FAQs)

1. How much money do I really need to retire comfortably?

The Northwestern Mutual study suggests $1.46 million is the new target for a comfortable retirement, but this is just an average. The actual amount you need depends on your individual circumstances, including your desired lifestyle, expected expenses, health status, and retirement age. Factors like where you plan to live, travel plans, and hobbies significantly impact your retirement needs. “Americans believe they need $65,000 per year to live comfortably in retirement,” notes the study, but even that figure is highly personalized. It’s best to consult with a financial advisor to create a personalized retirement plan that considers your specific needs and goals. They can help you estimate your expenses, project your income, and develop a savings and investment strategy that’s right for you. Also, utilize online retirement calculators as a starting point, but always remember that these are estimates and should be adjusted based on your individual situation. Don’t forget to factor in potential healthcare costs, which can be a significant expense in retirement.

2. Why is the retirement target so high, and why is it increasing so rapidly?

The retirement target is primarily driven by inflation and increased life expectancy. Inflation erodes the purchasing power of your savings, meaning you need more money to maintain the same standard of living. As the cost of goods and services rises, so does the amount you need to save for retirement. Increased life expectancy also plays a role. People are living longer, which means they need to save more to cover their expenses for a longer period of time. The rising cost of healthcare is another significant factor. Healthcare expenses tend to increase with age, so you need to plan for these costs when estimating your retirement needs. The Northwestern Mutual study indicated the target jumped 15% from 2023 alone, and 53% since 2020, underscoring the rapid pace of these increases. Finally, low interest rates in recent years have made it more difficult to generate returns on savings, requiring individuals to save even more to reach their retirement goals.

3. What if I’m already behind on my retirement savings? Is it too late to catch up?

It’s never too late to start saving for retirement, even if you’re behind. While starting early provides the greatest advantage due to compounding returns, there are still steps you can take to catch up later in life. Increase your savings rate as much as possible. Even small increases can make a big difference over time. Consider working longer or delaying retirement to give yourself more time to save and allow your investments to grow. “Younger generations are entering the workforce with significant financial burdens, making it harder to prioritize retirement savings,” said Gokhale. “They need to start saving early and take advantage of compounding returns to build a secure financial future,” but this advice applies at any age. Re-evaluate your budget and identify areas where you can cut expenses and redirect those savings towards retirement. Explore catch-up contributions to your retirement accounts. The IRS allows individuals age 50 and older to make additional contributions to 401(k)s and IRAs. Finally, consider consulting with a financial advisor who can help you develop a catch-up strategy tailored to your specific circumstances.

4. How does Social Security fit into my retirement plan? Can I rely on it?

Social Security is an important source of retirement income for many Americans, but it’s generally not sufficient to cover all of your expenses. It’s crucial to view Social Security as a supplement to your other retirement savings, not your sole source of income. The Social Security Administration projects that the Social Security trust funds will be depleted in the coming years, which could lead to benefit cuts. While Congress is likely to take action to address the shortfall, it’s prudent to plan for the possibility of reduced benefits. You can estimate your future Social Security benefits by using the Social Security Administration’s online calculator. Consider delaying retirement to increase your Social Security benefits. The longer you wait to claim benefits, the higher your monthly payment will be. Also, understand the different claiming strategies available to you, such as spousal benefits and survivor benefits. Coordinate your Social Security claiming strategy with your overall retirement plan.

5. What are the biggest mistakes people make when planning for retirement?

One of the biggest mistakes is not starting early enough. The earlier you start saving, the more time your money has to grow through the power of compounding. Another common mistake is underestimating the amount you need to save. Many people fail to account for inflation, healthcare costs, and other expenses that can erode their savings. Not diversifying your investments is another critical error. Putting all your eggs in one basket can expose you to unnecessary risk. Failing to rebalance your portfolio regularly is also a mistake. As you get closer to retirement, you may need to adjust your asset allocation to reduce risk. Another common error is not seeking professional financial advice. A qualified financial advisor can help you develop a personalized retirement plan and avoid costly mistakes. Finally, underestimating the impact of taxes on your retirement savings is a frequent oversight. Understand the tax implications of different retirement accounts and strategies. Procrastination, lack of financial literacy, and unrealistic expectations are all contributing factors to poor retirement planning.