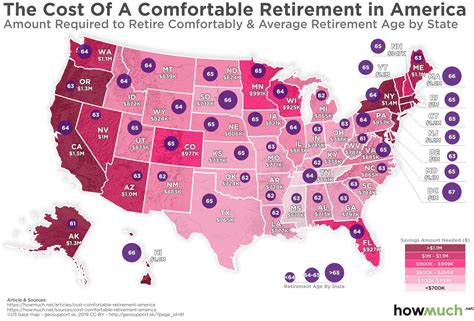

Most Americans are falling far short of the savings needed to retire comfortably, with a newly calculated target suggesting even higher savings goals than previously thought, leaving a staggering 97% of the population unprepared.

A recent analysis indicates that achieving a comfortable retirement now requires significantly more savings, placing the vast majority of Americans in a precarious position. While individual circumstances vary, financial experts emphasize the urgent need for increased savings and strategic planning to mitigate the risk of financial hardship in later life. The stark reality is that many are not on track to meet even basic retirement needs, let alone the elevated benchmark for a comfortable lifestyle.

According to GOBankingRates, the target retirement savings has risen to a substantial level, which has highlighted the retirement savings gap affecting a significant portion of the U.S. population. This new target underscores the growing challenges faced by individuals attempting to secure their financial future amidst rising living costs and economic uncertainties.

The findings reveal a concerning trend, with the vast majority of Americans lagging behind in their retirement savings. The increased savings target further exacerbates the issue, emphasizing the need for immediate action to address the retirement savings crisis. Experts recommend implementing effective savings strategies and seeking professional financial advice to improve retirement readiness.

The data paints a concerning picture, suggesting that most Americans are drastically underprepared for retirement, leading to questions about the adequacy of current savings strategies and the potential for a widespread retirement crisis. The analysis emphasizes the urgency of addressing this issue and implementing effective measures to improve retirement preparedness across the nation.

Understanding the Scope of the Retirement Crisis

The issue of retirement preparedness in the United States has been a subject of considerable discussion and concern for many years. Various studies and surveys have consistently highlighted the challenges faced by Americans in accumulating sufficient savings to maintain a comfortable standard of living throughout their retirement years. Factors contributing to this crisis include insufficient savings rates, inadequate financial literacy, and the increasing burden of debt.

The traditional model of retirement planning often assumes a consistent savings rate over an extended period, coupled with prudent investment strategies. However, economic realities such as wage stagnation, rising healthcare costs, and unexpected financial emergencies often disrupt these plans. As a result, many individuals find themselves falling behind in their retirement savings goals, leading to anxiety and uncertainty about their financial future.

Adding to the complexity is the shift away from traditional defined-benefit pension plans towards defined-contribution plans, such as 401(k)s. While these plans offer greater flexibility and portability, they also place the responsibility of investment decisions squarely on the shoulders of the individual. Many lack the knowledge and expertise to effectively manage their retirement savings, resulting in suboptimal investment choices and lower overall returns.

The New Retirement Savings Target: A Closer Look

The recently calculated retirement savings target represents a significant increase compared to previous benchmarks, reflecting the rising costs of healthcare, housing, and other essential expenses. The specific amount required for a comfortable retirement varies depending on individual circumstances, such as lifestyle preferences, geographic location, and health status. However, financial experts generally recommend saving at least 10 to 12 times one’s pre-retirement income to maintain a similar standard of living in retirement.

This new target takes into account factors such as inflation, longevity, and potential investment returns to provide a more realistic assessment of the savings needed to fund a comfortable retirement. It also considers the impact of taxes and healthcare expenses, which can significantly erode retirement savings over time. By incorporating these factors into the calculation, the new target offers a more comprehensive and accurate picture of the financial challenges facing retirees.

However, the increased savings target also poses a significant challenge for many Americans who are already struggling to save for retirement. For those who are nearing retirement age, catching up on their savings may seem like an insurmountable task. Even younger workers, who have more time to save, may find it difficult to reach the new target given competing financial priorities such as paying off student loans, buying a home, and raising a family.

Why Are So Many Falling Short?

Several factors contribute to the widespread retirement savings shortfall in the United States. One of the primary reasons is insufficient savings rates. Many Americans simply do not save enough money each year to reach their retirement goals. This may be due to a lack of financial literacy, competing financial priorities, or simply the perception that retirement is too far off to worry about.

Another factor is the burden of debt. Millions of Americans are burdened by student loans, credit card debt, and other forms of debt, which can significantly impede their ability to save for retirement. Paying off debt often takes precedence over saving, especially for younger workers who are just starting out in their careers.

Inadequate financial literacy also plays a significant role. Many individuals lack the knowledge and skills to effectively manage their finances, make informed investment decisions, and plan for retirement. This can lead to suboptimal savings and investment choices, resulting in lower overall returns.

Furthermore, the shift away from traditional pension plans has placed greater responsibility on individuals to manage their own retirement savings. While defined-contribution plans offer greater flexibility and portability, they also require individuals to make informed investment decisions and manage their savings effectively. Many lack the knowledge and expertise to do so, resulting in lower retirement savings.

Economic factors such as wage stagnation and rising healthcare costs also contribute to the retirement savings shortfall. Wages have not kept pace with inflation in recent decades, making it more difficult for workers to save for retirement. At the same time, healthcare costs have been rising rapidly, placing a significant burden on retirees and pre-retirees alike.

Strategies for Closing the Retirement Savings Gap

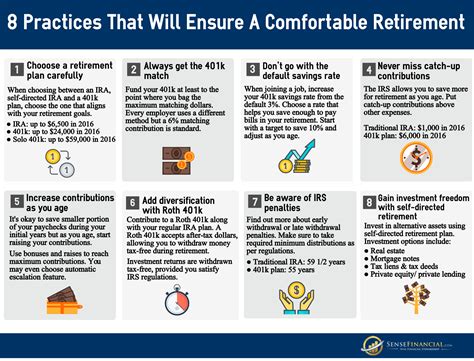

While the retirement savings shortfall may seem daunting, there are several strategies that individuals can implement to improve their retirement readiness. One of the most important steps is to increase savings rates. Even small increases in savings can make a significant difference over time, thanks to the power of compounding.

Individuals should also prioritize paying off debt, especially high-interest debt such as credit card debt. Reducing debt can free up more money to save for retirement and improve overall financial health.

Improving financial literacy is also crucial. Individuals should take the time to learn about personal finance, investing, and retirement planning. There are many resources available to help individuals improve their financial knowledge, including online courses, books, and workshops.

Another strategy is to take advantage of employer-sponsored retirement plans, such as 401(k)s. These plans offer several advantages, including tax-deferred savings and employer matching contributions. Participating in an employer-sponsored retirement plan can significantly boost retirement savings over time.

Individuals should also consider seeking professional financial advice. A qualified financial advisor can help individuals develop a personalized retirement plan, make informed investment decisions, and manage their savings effectively.

Delaying retirement can also be an effective way to boost retirement savings. Working longer allows individuals to continue saving and investing, while also delaying the need to draw on their retirement savings.

Finally, individuals should consider downsizing their lifestyle in retirement. Reducing expenses can help stretch retirement savings further and make it easier to maintain a comfortable standard of living.

Expert Opinions and Insights

Financial experts agree that the retirement savings shortfall is a serious issue that requires immediate attention. They emphasize the importance of saving early and often, taking advantage of employer-sponsored retirement plans, and seeking professional financial advice.

“The earlier you start saving for retirement, the better,” says certified financial planner Sophia Bera, CFP®. “Even small amounts saved consistently over time can grow significantly thanks to the power of compounding.”

Other experts recommend taking a more proactive approach to retirement planning, including setting clear financial goals, developing a detailed budget, and tracking progress regularly.

“Retirement planning is not a one-time event,” says David John, a senior policy advisor at the AARP Public Policy Institute. “It’s an ongoing process that requires regular monitoring and adjustments.”

Experts also emphasize the importance of diversifying investments to reduce risk and maximize returns.

“Diversification is key to building a successful retirement portfolio,” says certified financial analyst Michael Kitces, CFA. “Spreading your investments across different asset classes can help mitigate risk and improve overall returns.”

The consensus among financial experts is that addressing the retirement savings shortfall requires a multi-faceted approach that includes increased savings rates, improved financial literacy, and proactive retirement planning.

The Role of Government and Policy Makers

While individual responsibility plays a crucial role in retirement planning, government and policy makers also have a role to play in addressing the retirement savings shortfall. Several policy initiatives have been proposed to encourage greater retirement savings, including expanding access to employer-sponsored retirement plans, increasing the contribution limits for retirement accounts, and providing tax incentives for saving.

One such initiative is the Secure Act (Setting Every Community Up for Retirement Enhancement), which was signed into law in 2019. The Secure Act includes several provisions designed to make it easier for small businesses to offer retirement plans and for individuals to save for retirement.

Another proposal is to create a national retirement savings system, similar to Social Security, that would provide a guaranteed stream of income in retirement. Proponents of this idea argue that it would help ensure that all Americans have access to a basic level of retirement security.

Government and policy makers can also play a role in improving financial literacy. By promoting financial education in schools and communities, they can help individuals develop the knowledge and skills they need to manage their finances effectively and plan for retirement.

The Future of Retirement

The future of retirement is uncertain, but one thing is clear: Americans will need to save more and plan more carefully to ensure a comfortable retirement. The traditional model of retirement, which assumes a fixed retirement age and a steady stream of income, is no longer realistic for many.

Workers will need to be more flexible and adaptable in their retirement planning. This may mean working longer, delaying retirement, or finding alternative sources of income. It may also mean downsizing their lifestyle and reducing expenses.

The rise of the gig economy and the increasing prevalence of part-time work may also impact retirement planning. Workers may need to develop new strategies for saving and investing in these situations.

Despite the challenges, there is reason for optimism. With careful planning, disciplined saving, and a willingness to adapt, Americans can still achieve a comfortable and secure retirement.

The Impact on Different Age Groups

The retirement savings crisis impacts different age groups in varying ways. Younger workers have the advantage of time, allowing them to benefit from the power of compounding over a longer period. However, they also face challenges such as student loan debt and rising housing costs, which can make it difficult to save for retirement.

Mid-career workers may have accumulated some savings, but they also face competing financial priorities such as raising a family and paying for their children’s education. They may need to make some tough choices about how to allocate their resources.

Older workers who are nearing retirement age may have limited time to catch up on their savings. They may need to consider delaying retirement, working part-time, or downsizing their lifestyle.

The impact of the retirement savings crisis also varies depending on income level. Lower-income workers are less likely to have access to employer-sponsored retirement plans and may struggle to save even small amounts. Higher-income workers may have more resources to save, but they may also face higher taxes and expenses.

Conclusion

The new retirement savings target serves as a wake-up call for Americans who are not on track to meet their retirement goals. The vast majority of the population is falling short of the savings needed to retire comfortably, highlighting the urgent need for increased savings and strategic planning.

While the challenges may seem daunting, there are several steps that individuals can take to improve their retirement readiness. By increasing savings rates, paying off debt, improving financial literacy, and seeking professional financial advice, Americans can take control of their financial future and work towards a more secure retirement. Government and policy makers also have a role to play in addressing the retirement savings shortfall by expanding access to retirement plans, providing tax incentives for saving, and promoting financial education. The road to a comfortable retirement may be long and challenging, but with careful planning and disciplined saving, it is still within reach for many.

Frequently Asked Questions (FAQ)

-

How much should I realistically aim to save for retirement, given this new target?

According to GOBankingRates, the specific amount varies greatly depending on individual circumstances, desired lifestyle, and anticipated expenses. A general rule of thumb is to aim for at least 10 to 12 times your pre-retirement income. However, a more personalized calculation considering factors like inflation, healthcare costs, and investment returns is recommended. The original article does not provide a fixed number but suggests the need for significantly more than what most people currently have. It is recommended to consult with a financial advisor to determine the right target for your specific situation.

-

I’m already behind on my retirement savings. What are the most effective steps I can take to catch up?

Several strategies can help you catch up. First, increase your savings rate as much as possible, even if it means making lifestyle adjustments. Take full advantage of any employer-sponsored retirement plans, especially if they offer matching contributions. Consider working longer or delaying retirement to allow for more savings accumulation. Reducing debt, particularly high-interest debt, can free up more funds for retirement savings. Finally, consult with a financial advisor to develop a personalized catch-up plan.

-

What role does Social Security play in retirement, and should I rely on it as a primary source of income?

Social Security is intended to be a supplement to retirement income, not the primary source. The actual amount received from Social Security depends on your earnings history and the age at which you begin claiming benefits. Experts generally advise against relying solely on Social Security for retirement income, as it may not be sufficient to cover all expenses, especially with the rising costs of healthcare and housing. It’s crucial to supplement Social Security with personal savings and other retirement income sources.

-

How does inflation impact my retirement savings, and what can I do to mitigate its effects?

Inflation erodes the purchasing power of your savings over time. To mitigate its effects, consider investing in assets that tend to outpace inflation, such as stocks, real estate, and Treasury Inflation-Protected Securities (TIPS). Regularly review and adjust your investment portfolio to ensure it remains aligned with your long-term financial goals and inflation expectations. Also, factor inflation into your retirement planning calculations to estimate the future value of your savings and expenses.

-

What are some common mistakes people make when planning for retirement, and how can I avoid them?

Common mistakes include starting to save too late, underestimating expenses, failing to account for inflation, not diversifying investments, withdrawing funds early, and neglecting to seek professional financial advice. To avoid these mistakes, start saving early and consistently, create a realistic budget that accounts for both current and future expenses, factor inflation into your planning, diversify your investments to reduce risk, avoid early withdrawals from retirement accounts, and consult with a financial advisor to develop a comprehensive retirement plan tailored to your specific needs and goals.

The Psychological Impact of Retirement Insecurity

The realization that one is significantly behind on retirement savings can have profound psychological effects. Anxiety, stress, and even depression can arise from the fear of financial insecurity in later life. This stress can negatively impact current well-being, affecting relationships, work performance, and overall quality of life. Individuals facing this situation may experience sleep disturbances, increased irritability, and a sense of hopelessness.

The pressure to catch up on savings can also lead to unhealthy financial decisions, such as taking on excessive risk in investments or delaying necessary healthcare. It’s crucial to acknowledge these psychological effects and seek support from financial advisors, therapists, or support groups. Developing a realistic plan and taking small, actionable steps can help alleviate anxiety and restore a sense of control over one’s financial future. Open communication with family members about financial concerns can also provide emotional support and foster collaborative problem-solving.

The Importance of Financial Literacy Programs

Addressing the retirement savings crisis requires a comprehensive approach that includes improving financial literacy across all age groups. Financial literacy programs can equip individuals with the knowledge and skills needed to make informed financial decisions, manage their money effectively, and plan for the future. These programs should cover topics such as budgeting, saving, investing, debt management, and retirement planning.

Schools, community organizations, and employers can play a crucial role in providing financial literacy education. Integrating personal finance into school curricula can help young people develop sound financial habits from an early age. Workplace financial wellness programs can provide employees with access to financial education, counseling, and resources to improve their financial well-being. Community-based organizations can offer free or low-cost financial literacy workshops and seminars to help individuals in underserved communities.

By empowering individuals with the knowledge and skills they need to make informed financial decisions, financial literacy programs can contribute to a more financially secure future for all.

Rethinking Retirement: Alternative Strategies and Lifestyles

As traditional retirement becomes increasingly unattainable for many, individuals are exploring alternative strategies and lifestyles to achieve financial security and fulfillment in later life. One option is to embrace a “phased retirement,” gradually reducing work hours and responsibilities over time. This allows individuals to continue earning income while also enjoying more leisure time.

Another strategy is to pursue entrepreneurial ventures or freelance work in retirement. Many retirees find that starting a small business or offering their skills as a consultant can provide both financial income and a sense of purpose.

Location arbitrage is another option, relocating to a lower-cost area or country to reduce living expenses. This can allow retirees to stretch their savings further and enjoy a comfortable lifestyle on a smaller budget.

Some individuals are also exploring alternative housing options, such as co-housing communities or shared living arrangements, to reduce housing costs and foster social connections.

By rethinking retirement and exploring alternative strategies and lifestyles, individuals can create a more flexible and fulfilling path to financial security in later life.

Analyzing the Investment Landscape for Retirement Savers

Navigating the investment landscape effectively is crucial for building a robust retirement portfolio. A diversified portfolio that aligns with your risk tolerance and time horizon is essential. Stocks offer the potential for higher returns but also carry greater risk. Bonds provide more stability but typically offer lower returns. Real estate can be a valuable asset, but it also requires careful management.

Exchange-Traded Funds (ETFs) and mutual funds offer a convenient way to diversify your investments across a range of asset classes. Target-date funds automatically adjust their asset allocation over time, becoming more conservative as you approach retirement.

It’s also important to consider the fees and expenses associated with different investment options. High fees can erode your returns over time, so it’s important to choose low-cost investment options whenever possible.

Regularly review and rebalance your portfolio to ensure it remains aligned with your goals and risk tolerance. Market conditions can change over time, so it’s important to make adjustments as needed.

The Impact of Healthcare Costs on Retirement Planning

Healthcare costs are a significant and growing expense for retirees. Medicare provides basic health insurance coverage, but it doesn’t cover all healthcare expenses. Many retirees also need to purchase supplemental insurance to cover gaps in Medicare coverage.

Long-term care expenses, such as nursing home care or in-home care, can be particularly expensive. Planning for long-term care is an essential part of retirement planning.

Health Savings Accounts (HSAs) offer a tax-advantaged way to save for healthcare expenses. Contributions to an HSA are tax-deductible, earnings grow tax-free, and withdrawals for qualified healthcare expenses are tax-free.

Consider working with a financial advisor to develop a comprehensive healthcare plan as part of your overall retirement plan. This plan should include strategies for managing healthcare costs and ensuring access to quality healthcare throughout your retirement years.

The Importance of Estate Planning for Retirement Security

Estate planning is an essential part of retirement planning. An estate plan ensures that your assets are distributed according to your wishes after your death. A will is a legal document that specifies how your assets should be divided. A trust can be used to manage your assets during your lifetime and to transfer them to your heirs after your death.

A power of attorney allows you to appoint someone to make financial and healthcare decisions on your behalf if you become incapacitated. A healthcare directive, also known as a living will, allows you to specify your wishes regarding medical treatment if you are unable to communicate them yourself.

Working with an estate planning attorney can help you develop a comprehensive estate plan that protects your assets and ensures that your wishes are carried out.

The Broader Economic Implications of Retirement Insecurity

The retirement savings crisis has significant implications for the broader economy. A large number of underprepared retirees can strain social safety nets and reduce consumer spending. This can lead to slower economic growth and increased pressure on government resources.

Businesses may also face challenges as older workers delay retirement, reducing opportunities for younger workers to advance and enter the workforce.

Addressing the retirement savings crisis is not just a matter of individual financial security; it’s also essential for the long-term health and stability of the economy. Policies that encourage greater retirement savings and improve financial literacy can help create a more prosperous and equitable future for all.