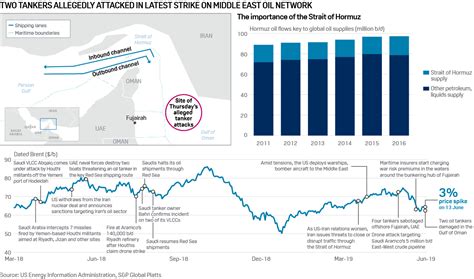

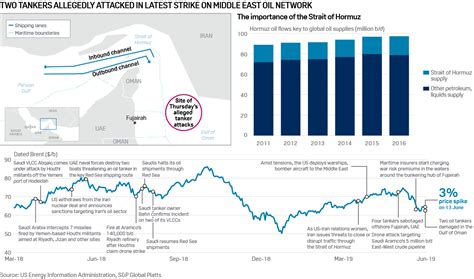

Oil prices jumped and global trade faced renewed uncertainty following heightened tensions surrounding the Strait of Hormuz after recent attacks and heightened rhetoric between Iran and the United States, raising concerns about potential disruptions to this critical chokepoint for global energy supplies.

The Strait of Hormuz, a narrow waterway connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea, remains a focal point of geopolitical anxiety as saber-rattling intensifies in the region. The recent rise in oil prices directly reflects market fears that escalating tensions could lead to disruptions in the flow of crude oil through this strategically vital passage. According to the U.S. Energy Information Administration (EIA), the Strait of Hormuz is crucial because it serves as the transit point for significant volumes of crude oil. “The Strait of Hormuz is the world’s most important oil chokepoint because of its daily oil flow.” Disruptions, whether through military action or other forms of interference, can have immediate and substantial impacts on global energy markets and trade.

Oil Price Surge and Market Reaction

The immediate impact of rising tensions has been a noticeable surge in oil prices. Market analysts are closely monitoring developments in the region, recognizing that any event that threatens the stability of the Strait of Hormuz could trigger a sharp increase in prices. Traders are factoring in the potential risk of supply disruptions, leading to increased buying activity and pushing prices upward. This price volatility affects not only major oil-producing and consuming nations but also has ripple effects across various sectors, including transportation, manufacturing, and consumer goods. Higher oil prices translate to increased costs for these sectors, potentially leading to inflationary pressures and slower economic growth.

Beyond the immediate price surge, there are concerns about the longer-term implications of sustained instability in the region. Investors are wary of the potential for further escalations, which could lead to more significant disruptions and greater market volatility. “Oil prices will remain volatile as geopolitical risks persist,” stated one analyst. The uncertainty surrounding the Strait of Hormuz is thus prompting a reassessment of risk premiums in oil contracts, with traders demanding higher compensation for the potential risks involved in trading oil that passes through the region.

Geopolitical Context and Regional Tensions

The Strait of Hormuz has long been a flashpoint for geopolitical tensions, given its strategic importance and the complex web of regional rivalries and international interests that converge there. The current escalation is rooted in a history of disputes and conflicts involving Iran, the United States, and other regional actors.

Iran has repeatedly asserted its right to control navigation in the Strait of Hormuz, viewing it as part of its sovereign territory and vital to its national security. In the past, Iranian officials have threatened to close the strait in response to perceived threats or sanctions, raising the specter of a major disruption to global oil supplies. These threats have often been accompanied by military exercises and displays of naval power, further fueling tensions in the region.

The United States, on the other hand, has maintained a strong naval presence in the Persian Gulf to ensure the free flow of commerce and to deter any actions that could threaten regional stability. The U.S. Navy regularly patrols the Strait of Hormuz and conducts joint exercises with regional allies to enhance maritime security. This presence is intended to reassure oil markets and to signal a commitment to maintaining the stability of the region.

Other regional actors, such as Saudi Arabia and the United Arab Emirates, also have a significant stake in the security of the Strait of Hormuz, as they rely on it for the export of their oil. These countries have close ties with the United States and often coordinate their security policies with Washington. Any disruption to the flow of oil through the strait would have a severe economic impact on these countries, making them strong advocates for maintaining its openness.

Potential Scenarios and Contingency Planning

The possibility of a closure of the Strait of Hormuz, whether through deliberate action or miscalculation, is a significant concern for policymakers and energy companies around the world. Various scenarios have been considered, ranging from limited disruptions caused by naval skirmishes to a complete blockade of the waterway.

In the event of a closure, the immediate impact would be a sharp reduction in the supply of oil reaching global markets. This would lead to a spike in prices, potentially causing economic hardship for consumers and businesses. Governments would likely respond by releasing strategic petroleum reserves and seeking alternative sources of supply.

Energy companies would also scramble to find alternative routes for their oil shipments, such as pipelines or overland routes. However, these options are often limited in capacity and may not be able to fully compensate for the loss of access to the Strait of Hormuz.

The International Energy Agency (IEA) plays a critical role in coordinating the response to supply disruptions, working with member countries to ensure that oil markets remain stable. The IEA has the authority to release emergency oil stocks and to encourage countries to increase production to offset any shortfalls.

Impact on Global Trade and Economy

The Strait of Hormuz is not only crucial for oil shipments but also for the broader flow of global trade. Many other goods and commodities pass through the waterway, making it a vital link in the global supply chain. A disruption to traffic through the strait could have far-reaching consequences for international trade and economic activity.

Companies that rely on the Strait of Hormuz for their supply chains could face delays, increased costs, and potential disruptions to their operations. This could lead to lower profits, reduced investment, and job losses. The impact would be felt across a wide range of industries, from manufacturing and retail to agriculture and tourism.

The economic consequences of a prolonged closure of the Strait of Hormuz could be severe, potentially triggering a global recession. The disruption to oil supplies would lead to higher energy prices, which would dampen economic growth and fuel inflation. The uncertainty surrounding the situation could also lead to a decline in business and consumer confidence, further exacerbating the economic downturn.

US Attack Implications

The specific “US attack” mentioned as a catalyst in the Yahoo Finance article likely refers to actions taken by the United States, whether military strikes or other forms of intervention, that have increased tensions with Iran. Without explicit details, this refers to the broader context of ongoing U.S.-Iran tensions, including but not limited to targeted strikes, cyber operations, or support for regional allies engaged in conflicts where Iranian-backed groups are involved. The ambiguity underscores the fragility of the situation, where any perceived aggression can dramatically alter regional dynamics and accelerate the risk of escalation.

The implications of any direct U.S. military action are significant. Such actions often elicit strong responses from Iran, potentially including asymmetric warfare tactics designed to disrupt shipping and energy infrastructure in the Strait of Hormuz. The response from Iran could range from naval mine deployments to attacks on tankers using fast boats or missiles. Additionally, the increased military presence and activity from both sides heighten the risk of accidental encounters or miscalculations, which could rapidly escalate into larger-scale conflicts.

Further, the political ramifications of a U.S. attack are broad. It could galvanize anti-American sentiment in the region, strengthening hardline factions within Iran and potentially undermining any prospects for diplomatic engagement. The response from other international actors would vary depending on their strategic interests. U.S. allies in the region might offer support, while other nations might call for restraint and de-escalation. This divergence of views could strain international relations and create further instability.

Alternative Routes and Strategies

Recognizing the risks associated with relying on the Strait of Hormuz, various efforts have been made to develop alternative routes for oil and gas shipments. These include pipelines, overland routes, and the development of new ports and terminals outside the Persian Gulf.

One notable example is the East-West Pipeline in Saudi Arabia, which allows oil to be transported from the eastern part of the country to the Red Sea, bypassing the Strait of Hormuz. This pipeline has a capacity of several million barrels per day and provides a valuable alternative route for Saudi oil exports.

Another option is the development of new ports and terminals in countries such as Oman and the United Arab Emirates, which are located outside the Persian Gulf. These facilities could be used to load and unload oil shipments, reducing the reliance on the Strait of Hormuz.

However, these alternative routes and strategies are often costly and time-consuming to implement. They also may not be able to fully compensate for the loss of access to the Strait of Hormuz, particularly in the event of a prolonged closure.

Diplomatic Efforts and De-escalation

Given the high stakes involved, diplomatic efforts to de-escalate tensions in the region are crucial. Various countries and international organizations have been working to mediate between Iran and the United States and to find a peaceful resolution to the ongoing disputes.

The European Union has played a particularly active role in trying to preserve the Iran nuclear deal, which was designed to prevent Iran from developing nuclear weapons. The EU has also sought to facilitate dialogue between Iran and the United States and to address the underlying issues that are fueling tensions in the region.

Other countries, such as Oman and Qatar, have also served as intermediaries between Iran and the United States, using their close ties with both sides to try to bridge the gap. These diplomatic efforts are essential for preventing further escalation and for creating the conditions for a more stable and secure region.

Long-Term Implications

The situation in the Strait of Hormuz highlights the vulnerability of the global energy system to geopolitical risks. The potential for disruptions to oil supplies from the region underscores the need for diversification of energy sources and the development of alternative energy technologies.

Countries around the world are increasingly investing in renewable energy sources, such as solar, wind, and hydropower, to reduce their reliance on fossil fuels. These investments are not only beneficial for the environment but also enhance energy security by reducing dependence on volatile regions.

The development of alternative energy technologies, such as electric vehicles and energy storage systems, is also helping to reduce demand for oil and to mitigate the impact of supply disruptions. These technologies offer the potential for a more resilient and sustainable energy system that is less vulnerable to geopolitical risks.

In the long term, the situation in the Strait of Hormuz could accelerate the transition to a cleaner and more diversified energy system. The risks associated with relying on fossil fuels from politically unstable regions may prompt countries to accelerate their efforts to develop alternative energy sources and to reduce their dependence on oil.

Cyber Warfare and Modern Threats

Beyond traditional military posturing, the specter of cyber warfare looms large over the Strait of Hormuz situation. In modern conflicts, cyberattacks can cripple critical infrastructure, including port operations, shipping logistics, and even oil and gas production facilities. A successful cyberattack could effectively close the Strait without a single shot being fired, causing just as much disruption as a physical blockade.

Iran has demonstrated advanced cyber capabilities, and could potentially target U.S. or allied assets in retaliation for perceived aggression. This includes targeting critical infrastructure, financial institutions, and government networks. Conversely, the U.S. possesses even more sophisticated cyber warfare capabilities and could similarly target Iranian infrastructure.

The anonymity and deniability inherent in cyberattacks make them an attractive option for both sides, as they can inflict significant damage without triggering a full-scale military response. However, the risk of miscalculation and escalation is high, as it can be difficult to attribute cyberattacks with certainty, leading to retaliatory actions that further destabilize the region.

To mitigate these risks, enhanced cybersecurity measures are crucial for all stakeholders involved. This includes protecting critical infrastructure, improving threat detection capabilities, and developing clear protocols for responding to cyberattacks. International cooperation is also essential, as cyber warfare transcends national borders and requires a coordinated global response.

Insurance and Shipping Costs

The increased tensions in the Strait of Hormuz have a direct impact on insurance and shipping costs for vessels transiting the region. Insurers are demanding higher premiums to cover the increased risk of attacks, seizures, or other incidents that could damage or destroy ships. These higher insurance costs are passed on to shipping companies, which in turn increase their freight rates.

The higher shipping costs make it more expensive to transport goods through the Strait of Hormuz, which can lead to higher prices for consumers and businesses. It also reduces the competitiveness of companies that rely on the strait for their supply chains.

In some cases, shipping companies may choose to avoid the Strait of Hormuz altogether, opting for longer and more expensive routes. This can add significant time and cost to shipments, further disrupting global trade.

The increased insurance and shipping costs are a direct consequence of the heightened geopolitical risks in the region. They highlight the economic impact of instability and the need for de-escalation to restore confidence in the safety of maritime trade.

The Role of Regional Players

Beyond the direct tensions between the U.S. and Iran, the actions and interests of other regional players significantly influence the situation in the Strait of Hormuz. Saudi Arabia, the UAE, Qatar, and Oman all have vested interests in the stability and security of the region, but their approaches and allegiances vary.

Saudi Arabia and the UAE have traditionally been strong allies of the U.S. and view Iran as a major regional threat. They have supported efforts to contain Iran’s influence and have participated in joint military exercises with the U.S. to enhance maritime security.

Qatar, on the other hand, has maintained relatively good relations with Iran, despite its close ties with the U.S. Qatar shares a large natural gas field with Iran and has sought to mediate between Iran and its rivals.

Oman has also played a mediating role in the region, using its historical ties with both Iran and the U.S. to facilitate dialogue and de-escalation.

The complex web of relationships and rivalries among these regional players adds another layer of complexity to the situation in the Strait of Hormuz. Any efforts to resolve the tensions in the region must take into account the interests and concerns of all stakeholders.

Environmental Risks

Beyond the economic and geopolitical implications, the potential for environmental disaster looms large in the Strait of Hormuz. A military conflict or deliberate sabotage could lead to oil spills, damage to marine ecosystems, and long-term environmental contamination.

The Strait of Hormuz is a fragile marine environment, home to a diverse array of marine life, including coral reefs, fish, and marine mammals. An oil spill could devastate these ecosystems, harming wildlife and disrupting the food chain.

In addition to oil spills, military activities could also damage critical infrastructure, such as desalination plants and power plants, which could have serious consequences for the region’s water and energy supplies.

The potential for environmental disaster underscores the importance of de-escalation and peaceful resolution of the tensions in the Strait of Hormuz. The long-term consequences of a major environmental incident could be devastating for the region and the world.

FAQ: Strait of Hormuz and Oil Market Impacts

Q1: Why is the Strait of Hormuz so important?

A1: The Strait of Hormuz is a critical chokepoint for global oil supplies, serving as the transit route for a significant percentage of the world’s crude oil. Any disruption to traffic through the strait can have immediate and substantial impacts on global energy markets and trade. The U.S. Energy Information Administration calls it “the world’s most important oil chokepoint.”

Q2: What could cause the Strait of Hormuz to close?

A2: The Strait could be closed due to a variety of factors, including military conflict, deliberate action by Iran, accidents involving large vessels, or cyberattacks targeting shipping infrastructure. Escalating tensions between Iran and the United States, as well as regional instability, increase the risk of closure.

Q3: How would a closure of the Strait of Hormuz affect oil prices?

A3: A closure of the Strait of Hormuz would likely lead to a sharp increase in oil prices due to reduced supply and increased uncertainty. The magnitude of the price increase would depend on the duration of the closure and the availability of alternative supply routes.

Q4: What are the alternative routes for oil shipments if the Strait of Hormuz is closed?

A4: Alternative routes include pipelines such as the East-West Pipeline in Saudi Arabia, overland routes, and the development of new ports and terminals outside the Persian Gulf. However, these options may have limited capacity and could not fully compensate for the loss of access to the Strait of Hormuz.

Q5: What is the role of the United States in the Strait of Hormuz?

A5: The United States maintains a strong naval presence in the Persian Gulf to ensure the free flow of commerce and deter actions that could threaten regional stability. The U.S. Navy regularly patrols the Strait of Hormuz and conducts joint exercises with regional allies to enhance maritime security. This is intended to reassure oil markets and signal a commitment to maintaining the region’s stability.