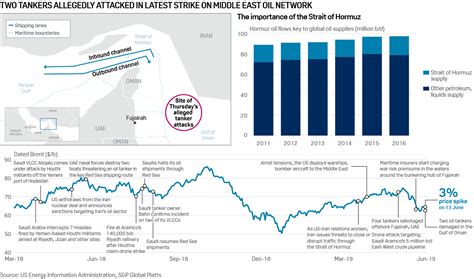

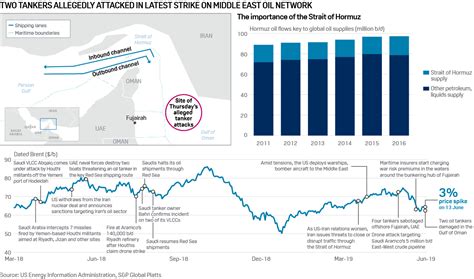

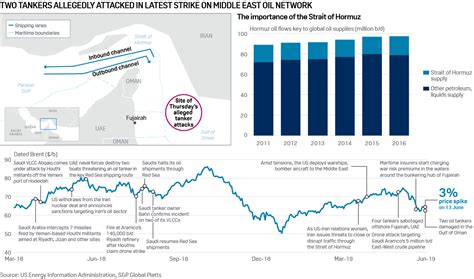

Oil prices are fluctuating amid escalating tensions in the Strait of Hormuz following recent U.S. strikes against Iranian-backed groups in Syria and Iraq. The strategic waterway, a critical chokepoint for global oil supplies, could potentially face disruptions, raising concerns about a surge in crude oil prices and broader impacts on international trade.

The Strait of Hormuz, a narrow channel between Oman and Iran, is a crucial transit route for approximately 20% of the world’s total oil supply. Any disruption to maritime traffic through the strait could trigger significant volatility in energy markets and destabilize the global economy. According to a recent report by the U.S. Energy Information Administration (EIA), over 21 million barrels per day of crude oil and petroleum products traversed the Strait in 2023. The concentration of such a large volume of oil shipments makes it a highly sensitive area, vulnerable to geopolitical tensions and military actions.

“The Strait of Hormuz is arguably the most important chokepoint in the world,” said Helima Croft, head of global commodity strategy at RBC Capital Markets. “Any closure, even temporary, could send oil prices soaring and create significant economic disruptions.”

The recent U.S. strikes, conducted in response to attacks on American personnel in the region, have heightened tensions between the U.S. and Iran, increasing the risk of retaliatory actions that could impact shipping in the Strait. Iran has previously threatened to close the Strait in response to sanctions and military pressure.

“Iran has repeatedly signaled its capability and willingness to disrupt traffic through the Strait of Hormuz,” stated a report by the International Institute for Strategic Studies (IISS). “While a full-scale closure is unlikely due to the economic consequences for Iran itself, targeted attacks on vessels or the laying of mines could create significant disruptions and raise insurance costs.”

The potential impact on oil prices is a major concern. Analysts at Goldman Sachs estimate that a prolonged closure of the Strait could push Brent crude prices above $150 per barrel. “The actual impact on oil prices will depend on the duration of the closure and the availability of alternative supply routes,” they noted in a research note.

While a complete closure of the Strait remains a relatively low-probability event, the increased risks have already led to higher insurance premiums for tankers transiting the area. “Insurance rates for ships passing through the Strait have increased by as much as 50% in recent weeks,” according to a statement from a leading maritime insurance company.

Beyond oil prices, the disruption of trade through the Strait could impact a wide range of industries. The waterway is also a vital route for container ships carrying goods between Asia and Europe. A closure could lead to delays in shipments, higher transportation costs, and disruptions to supply chains.

“The closure of the Strait of Hormuz would have significant implications for global trade, impacting not only the energy sector but also manufacturing, retail, and other industries,” said Peter Sand, chief analyst at Xeneta, a freight rate benchmarking firm.

The U.S. Navy maintains a strong presence in the Persian Gulf and has vowed to ensure the freedom of navigation through the Strait of Hormuz. “We are committed to working with our partners to maintain the security of the Strait and ensure the free flow of commerce,” said a spokesperson for the U.S. Fifth Fleet.

However, the effectiveness of these efforts will depend on the nature of any Iranian actions and the broader geopolitical context. A miscalculation or escalation could quickly lead to a more serious crisis.

Background on the Strait of Hormuz

The Strait of Hormuz is a 21-mile-wide (at its narrowest point) waterway located between Oman and Iran, connecting the Persian Gulf with the Gulf of Oman and the Arabian Sea. Its strategic importance stems from its role as the primary route for oil exports from major producers such as Saudi Arabia, Iran, the United Arab Emirates, Kuwait, and Iraq.

The Strait’s significance dates back centuries, with various empires and powers vying for control of the region due to its strategic location. In the modern era, its importance has grown exponentially with the rise of the oil industry.

Historical Incidents and Tensions

The Strait of Hormuz has been the site of numerous incidents and confrontations throughout history, reflecting the region’s geopolitical volatility:

- Iran-Iraq War (1980-1988): During this conflict, both sides targeted oil tankers in the Strait in an attempt to disrupt the other’s oil exports, leading to the “Tanker War.”

- USS Vincennes Incident (1988): The U.S. Navy cruiser USS Vincennes mistakenly shot down an Iranian passenger plane over the Strait, killing all 290 people on board.

- Various Seizures and Attacks: In recent years, there have been several incidents involving the seizure of tankers by Iran and attacks on vessels transiting the Strait, often attributed to Iranian-backed forces.

- 2019 Tanker Attacks: In May and June 2019, several oil tankers were attacked in the Gulf of Oman, with the U.S. and Saudi Arabia blaming Iran for the incidents. Iran denied involvement.

These incidents highlight the inherent risks associated with operating in the Strait of Hormuz and the potential for miscalculations or escalations to lead to broader conflicts.

Alternative Routes and Contingency Plans

While the Strait of Hormuz is the primary route for oil exports from the Persian Gulf, there are some alternative routes and contingency plans in place:

- East-West Pipeline (Saudi Arabia): This pipeline allows Saudi Arabia to bypass the Strait and export oil through the Red Sea. However, its capacity is limited.

- Abu Dhabi Crude Oil Pipeline (UAE): This pipeline enables the UAE to export oil from Fujairah on the Gulf of Oman, avoiding the Strait.

- Strategic Petroleum Reserves: Many countries, including the U.S., maintain strategic petroleum reserves that can be drawn upon in the event of a supply disruption.

- Increased Production from Other Regions: In the event of a Strait closure, other oil-producing regions, such as North America and Africa, could increase production to offset the shortfall.

However, these alternatives may not be sufficient to fully compensate for a prolonged closure of the Strait, and their effectiveness would depend on the specific circumstances.

Geopolitical Implications

The Strait of Hormuz is a key geopolitical flashpoint, with implications for regional stability and global power dynamics. The U.S. has long maintained a strong military presence in the Persian Gulf to protect its interests and ensure the freedom of navigation. However, this presence has also been a source of tension with Iran, which views the U.S. military presence as a threat to its security.

The Strait is also a factor in the broader rivalry between Saudi Arabia and Iran, who are competing for regional influence. Any disruption to oil exports through the Strait could exacerbate these tensions and lead to further instability.

Economic Impact

The economic impact of a Strait of Hormuz closure would be far-reaching, affecting not only the energy sector but also global trade, finance, and economic growth.

- Oil Price Spike: A closure would likely lead to a sharp increase in oil prices, as global supply would be constrained. This would, in turn, increase the cost of transportation, manufacturing, and other industries.

- Inflation: Higher energy prices would contribute to inflation, eroding consumers’ purchasing power and potentially leading to slower economic growth.

- Disruptions to Supply Chains: The closure could disrupt supply chains for a wide range of goods, as many products are transported through the Strait. This could lead to shortages, delays, and higher prices.

- Financial Market Volatility: Uncertainty about the situation in the Strait could lead to increased volatility in financial markets, as investors become risk-averse.

The magnitude of the economic impact would depend on the duration of the closure and the effectiveness of contingency plans to mitigate the disruption.

Potential Scenarios

Several potential scenarios could unfold in the Strait of Hormuz, each with different implications:

- Targeted Attacks on Vessels: Iran or its proxies could launch targeted attacks on oil tankers or other vessels transiting the Strait, disrupting shipping and raising insurance costs.

- Mining of the Strait: Iran could mine the Strait, making it dangerous for ships to navigate and effectively closing it off to traffic.

- Seizure of Vessels: Iran could seize vessels transiting the Strait, as it has done in the past, to exert political pressure or retaliate against perceived grievances.

- Full-Scale Closure: In a more extreme scenario, Iran could attempt to completely close the Strait to all traffic, potentially triggering a military confrontation with the U.S. and its allies.

The likelihood of each scenario depends on a complex interplay of political, military, and economic factors.

Role of International Actors

Numerous international actors have a stake in the security of the Strait of Hormuz, including:

- United States: The U.S. has long been the primary guarantor of security in the Persian Gulf, with a strong military presence in the region.

- Iran: Iran views the Strait as its strategic backyard and is determined to maintain its influence in the region.

- Saudi Arabia: Saudi Arabia is a major oil producer and exporter and relies heavily on the Strait for its oil shipments.

- United Arab Emirates: The UAE also relies on the Strait for its oil exports and has invested in alternative pipeline routes to reduce its dependence on the waterway.

- China: China is a major importer of oil from the Persian Gulf and has a growing interest in the security of the region.

- European Union: The EU relies on oil imports from the Persian Gulf and is concerned about the potential for disruptions to supply.

The actions of these actors will play a crucial role in shaping the future of the Strait of Hormuz and its impact on the global economy.

Current Situation Analysis

As of the latest reports, the situation in the Strait of Hormuz remains tense but stable. The U.S. military presence has been reinforced, and diplomatic efforts are underway to de-escalate tensions between the U.S. and Iran. However, the risk of further incidents or escalations remains high, given the underlying geopolitical dynamics.

The oil market is closely monitoring the situation, with prices fluctuating in response to news and rumors. Insurance rates for tankers transiting the Strait have increased, reflecting the heightened risk.

Conclusion

The Strait of Hormuz is a critical chokepoint for global oil supplies and a key geopolitical flashpoint. Recent U.S. strikes against Iranian-backed groups have heightened tensions in the region, increasing the risk of disruptions to maritime traffic through the Strait. While a complete closure remains unlikely, the potential impact on oil prices and global trade is significant. The situation requires careful monitoring and diplomatic efforts to prevent further escalation and ensure the security of this vital waterway. The next few weeks will be critical in determining whether the current tensions can be de-escalated or whether the region is heading towards a more serious crisis. The global economy remains vulnerable to any disruption in this crucial waterway.

Frequently Asked Questions (FAQ)

-

Why is the Strait of Hormuz so important? The Strait of Hormuz is critical because it is a narrow waterway through which a substantial portion of the world’s oil supply passes. Approximately 20% of the global oil supply transits through this strait daily, making it a vital artery for energy markets. Disruptions to traffic here can significantly impact oil prices and global trade.

-

What actions have led to increased tensions in the Strait recently? Increased tensions stem from a series of events, including recent U.S. military strikes against Iranian-backed groups in Iraq and Syria. These strikes, conducted in response to attacks on American personnel, have raised concerns about potential retaliation from Iran, which could disrupt shipping in the Strait.

-

What could happen if the Strait of Hormuz were closed? If the Strait of Hormuz were closed, even temporarily, it could lead to a significant spike in oil prices due to reduced supply. This could also disrupt global trade, impacting various industries that rely on the waterway for transporting goods between Asia, Europe, and the Middle East. Insurance costs for ships would likely increase dramatically, further affecting trade economics.

-

What are the alternative routes if the Strait of Hormuz is inaccessible? Alternative routes do exist, but they have limitations. Saudi Arabia has the East-West Pipeline to the Red Sea, and the UAE has the Abu Dhabi Crude Oil Pipeline to the Gulf of Oman. However, these pipelines cannot fully compensate for the volume of oil that passes through the Strait. Additionally, countries can tap into strategic petroleum reserves and other regions could increase oil production, but these measures might not fully offset the impact of a prolonged closure.

-

What is the U.S. doing to ensure the Strait remains open? The U.S. Navy maintains a strong presence in the Persian Gulf and has stated its commitment to ensuring freedom of navigation through the Strait of Hormuz. The U.S. works with allies to monitor the region and deter actions that could disrupt shipping. However, the effectiveness of these efforts depends on the nature of any potential threats and the broader geopolitical situation.