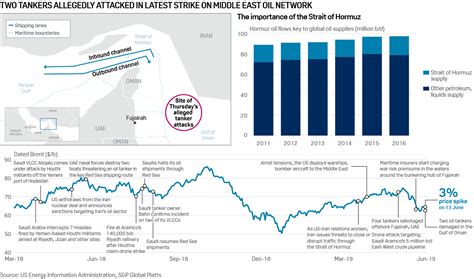

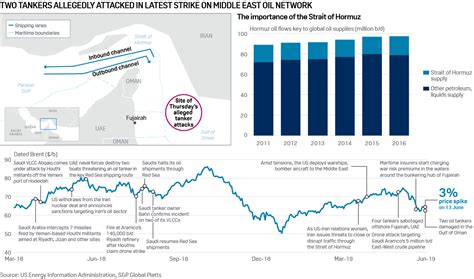

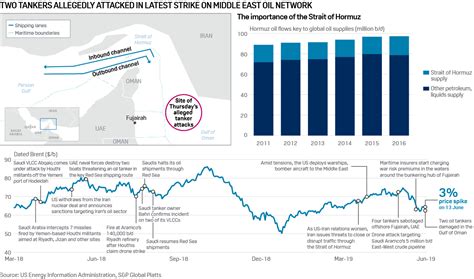

Oil prices are fluctuating amid escalating tensions in the Strait of Hormuz following recent U.S. strikes, raising concerns about potential disruptions to global trade and energy supplies. The critical waterway, a vital transit point for crude oil, could face closure or restricted passage, triggering economic repercussions worldwide.

The escalation follows a series of incidents, culminating in U.S. military actions that have heightened the risk of confrontation. “The geopolitical risk premium is back in oil prices,” notes an analyst at a leading investment bank, reflecting market anxieties over potential supply disruptions.

Strait of Hormuz: A Critical Chokepoint

The Strait of Hormuz, a narrow channel between Oman and Iran, is one of the world’s most strategically important waterways. It connects the oil-rich Persian Gulf to the Indian Ocean, serving as a crucial transit route for crude oil and other hydrocarbons. According to the U.S. Energy Information Administration (EIA), approximately 21 million barrels per day (bpd) of crude oil and petroleum products traversed the Strait in 2018, representing about 21% of global petroleum consumption. This figure underscores the Strait’s significance to the global energy market.

The waterway’s narrowness, at its smallest point only 21 miles wide, makes it particularly vulnerable to closure or disruption. Any impediment to traffic through the Strait can have immediate and significant impacts on oil prices, shipping costs, and overall global trade.

Recent Escalations and US Strikes

Tensions in the region have been simmering for years, exacerbated by geopolitical rivalries, proxy conflicts, and disputes over maritime boundaries. Recent incidents, including attacks on oil tankers, drone strikes on Saudi Arabian oil facilities, and seizures of vessels, have intensified concerns about the stability of the region.

The U.S. military actions, prompted by perceived threats to its interests and allies, have further heightened the risk of escalation. While the specific details of the strikes remain somewhat opaque, their impact on regional dynamics is undeniable. The strikes have been interpreted by some as a deterrent, while others view them as a provocation that could trigger retaliatory measures.

“The key question is whether these strikes are seen as a one-off event or the start of a sustained campaign,” says a geopolitical strategist. “The answer to that question will determine the level of risk to shipping in the Strait.”

Potential Scenarios: Closure and Disruption

The possibility of the Strait of Hormuz being closed, either partially or completely, is a recurring concern in the energy market. Iran has, on several occasions, threatened to close the Strait in response to perceived threats or sanctions. While a complete closure remains a relatively low-probability event, even a temporary or partial disruption could have significant consequences.

Several scenarios could lead to disruptions:

- Direct Military Conflict: An armed conflict between Iran and the U.S. or its allies could result in naval blockades or attacks on vessels transiting the Strait.

- Mine Warfare: Iran has the capability to lay mines in the Strait, which could damage or destroy ships and disrupt traffic.

- Harassment and Seizures: Iranian forces could harass or seize vessels transiting the Strait, as they have done in the past, creating delays and uncertainty.

- Terrorist Attacks: Terrorist groups operating in the region could target vessels or infrastructure in the Strait.

Impact on Oil Prices

The immediate impact of heightened tensions in the Strait of Hormuz is typically a rise in oil prices. Market participants factor in the increased risk of supply disruptions, leading to a “geopolitical risk premium” being added to the price of crude oil.

The magnitude of the price increase depends on several factors, including the severity of the perceived threat, the duration of any disruption, and the availability of alternative supply routes. In the event of a complete closure of the Strait, oil prices could spike dramatically, potentially reaching levels not seen in decades.

Analysts at Goldman Sachs estimate that a sustained closure of the Strait could push oil prices above $150 per barrel. Other analysts have suggested even higher price targets, depending on the severity and duration of the disruption.

Impact on Global Trade

Beyond oil, the Strait of Hormuz is also a crucial transit route for other goods, including liquefied natural gas (LNG), petrochemicals, and manufactured products. A disruption to traffic through the Strait could therefore have broader implications for global trade.

Shipping companies would face increased costs due to longer routes and higher insurance premiums. Supply chains would be disrupted, leading to delays and shortages of goods. Businesses that rely on imports and exports through the Strait would be particularly vulnerable.

The economic impact would be felt worldwide, with countries that are heavily reliant on oil imports being the most affected.

Alternative Routes and Mitigation Strategies

While the Strait of Hormuz is the most important route for oil exports from the Persian Gulf, there are some alternative routes that could be used to mitigate the impact of a disruption.

- The East-West Pipeline (Petroline): This pipeline runs across Saudi Arabia, connecting the country’s eastern oil fields to the Red Sea. It has a capacity of approximately 5 million bpd.

- The Abu Dhabi Crude Oil Pipeline (ADCOP): This pipeline runs from Abu Dhabi in the United Arab Emirates to Fujairah on the Gulf of Oman. It has a capacity of approximately 1.5 million bpd.

- The Saudi-Bahrain Pipeline: This pipeline transports crude oil from Saudi Arabia to Bahrain. It has a capacity of approximately 230,000 bpd.

However, these alternative routes have limited capacity and would not be able to fully compensate for a closure of the Strait of Hormuz.

Other mitigation strategies include increasing oil production from other regions, such as North America, and releasing strategic petroleum reserves. The U.S. Strategic Petroleum Reserve (SPR), for example, holds hundreds of millions of barrels of crude oil that can be released in the event of a supply disruption.

The Role of Diplomacy

Given the potential for catastrophic consequences, diplomatic efforts to de-escalate tensions in the region are crucial. Dialogue between the U.S. and Iran, as well as engagement with regional powers, could help to reduce the risk of conflict and ensure the safe passage of ships through the Strait of Hormuz.

“A diplomatic solution is the only sustainable way to ensure stability in the region,” says a former U.S. diplomat. “Military action can only address the symptoms of the problem, not the underlying causes.”

However, diplomatic efforts have been hampered by mistrust and a lack of communication between the key players. Bridging this gap will be essential to prevent further escalation and safeguard global energy supplies.

Long-Term Implications

The ongoing tensions in the Strait of Hormuz highlight the vulnerability of the global energy market to geopolitical risks. In the long term, this could accelerate the transition to alternative energy sources and reduce the world’s reliance on oil from the Persian Gulf.

Investments in renewable energy, such as solar and wind power, are already increasing rapidly. The development of electric vehicles and other energy-efficient technologies could further reduce oil demand.

However, the transition to a low-carbon economy will take time, and oil will likely remain an important part of the global energy mix for decades to come. In the meantime, ensuring the security of the Strait of Hormuz will remain a critical priority for governments and businesses around the world.

Expert Opinions and Market Reactions

Market analysts are closely monitoring the situation, with opinions varying on the likely course of events and their potential impact. Some believe that the tensions will eventually de-escalate, while others warn of a higher risk of conflict.

“We are in a period of heightened uncertainty, and the market is likely to remain volatile,” says an energy market strategist. “Investors should be prepared for a wide range of possible outcomes.”

The International Energy Agency (IEA) has also weighed in on the situation, emphasizing the importance of maintaining stable oil supplies. The IEA has urged countries to be prepared to release strategic petroleum reserves if necessary.

The Broader Geopolitical Context

The situation in the Strait of Hormuz cannot be viewed in isolation. It is part of a broader geopolitical context that includes regional rivalries, international sanctions, and the rise of new powers.

The U.S. withdrawal from the Iran nuclear deal in 2018 has further heightened tensions, as Iran has responded by gradually rolling back its commitments under the agreement. The reimposition of U.S. sanctions has crippled the Iranian economy, leading to increased frustration and a greater willingness to take risks.

Other regional players, such as Saudi Arabia, the United Arab Emirates, and Israel, also have a vested interest in the stability of the region. Their actions and reactions will play a key role in shaping the future of the Strait of Hormuz.

Frequently Asked Questions (FAQ)

Q1: What is the Strait of Hormuz and why is it important?

A1: The Strait of Hormuz is a narrow waterway between Oman and Iran, connecting the Persian Gulf to the Indian Ocean. It’s one of the world’s most strategically important chokepoints for oil transit. Approximately 21% of global petroleum consumption passes through it daily, making it crucial for global energy security. Any disruption there can significantly impact oil prices and global trade.

Q2: What recent events have led to the current tensions in the Strait of Hormuz?

A2: Tensions have escalated due to a series of incidents, including attacks on oil tankers, drone strikes on Saudi Arabian oil facilities, and seizures of vessels. Recent U.S. military actions, prompted by perceived threats, have further heightened the risk of confrontation and raised concerns about the stability of the region. These actions have been interpreted differently, with some viewing them as deterrents and others as provocations.

Q3: What are the potential scenarios if the Strait of Hormuz is closed?

A3: Several scenarios could lead to disruptions: direct military conflict, mine warfare, harassment and seizures of vessels by Iranian forces, and terrorist attacks. A complete closure could cause oil prices to spike dramatically, potentially exceeding $150 per barrel, according to some analysts. Even a partial disruption would lead to increased shipping costs, supply chain disruptions, and economic repercussions worldwide.

Q4: Are there alternative routes to transport oil if the Strait of Hormuz is blocked?

A4: Yes, there are alternative routes, but their capacity is limited. The East-West Pipeline (Petroline) in Saudi Arabia has a capacity of approximately 5 million bpd. The Abu Dhabi Crude Oil Pipeline (ADCOP) has a capacity of approximately 1.5 million bpd. These routes, however, cannot fully compensate for a complete closure of the Strait. Other mitigation strategies include increasing oil production from other regions and releasing strategic petroleum reserves.

Q5: What diplomatic efforts are underway to de-escalate tensions in the region?

A5: Diplomatic efforts are considered crucial for de-escalating tensions. Dialogue between the U.S. and Iran, along with engagement with regional powers, is essential to reduce the risk of conflict and ensure safe passage through the Strait. However, these efforts are hampered by mistrust and a lack of communication between key players. Overcoming this gap is vital to prevent further escalation and protect global energy supplies. A diplomatic solution is seen as the only sustainable way to ensure stability, as military action only addresses the symptoms of the problem.

Expanded Analysis and Background

The current situation in the Strait of Hormuz is not just a localized issue; it’s a complex intersection of historical grievances, economic pressures, and geopolitical ambitions. Understanding the historical context is crucial to grasping the depth of the current crisis.

Historical Context:

The Persian Gulf region has been a focal point of international power struggles for centuries. The British Empire exerted considerable influence in the region throughout the 19th and 20th centuries, seeking to protect its access to oil and maintain control over vital trade routes. Following Britain’s decline after World War II, the United States gradually assumed a more prominent role, forging alliances with regional powers like Saudi Arabia and maintaining a significant military presence in the area.

The Iranian Revolution of 1979 dramatically altered the geopolitical landscape. The overthrow of the U.S.-backed Shah and the establishment of an Islamic Republic led to a period of intense hostility between Iran and the United States. The Iran-Iraq War (1980-1988), which saw both sides attack oil tankers in the Persian Gulf, further underscored the region’s vulnerability and the potential for conflict to disrupt global energy supplies.

Economic Pressures:

The Iranian economy has been under immense pressure since the U.S. withdrew from the Iran nuclear deal in 2018 and reimposed sanctions. These sanctions have targeted Iran’s oil exports, its banking sector, and its access to international financial markets. As a result, Iran’s economy has contracted sharply, leading to widespread unemployment and social unrest.

The economic pressure on Iran has contributed to its more assertive foreign policy, including its support for proxy groups in the region and its threats to close the Strait of Hormuz. Iran views these actions as a way to exert leverage and force the U.S. to reconsider its sanctions policy.

Geopolitical Ambitions:

The Strait of Hormuz is also a battleground for competing geopolitical ambitions. Iran seeks to assert its dominance in the region and challenge the U.S.-led security architecture. Saudi Arabia, a key U.S. ally and Iran’s main regional rival, is determined to contain Iranian influence and maintain its position as a leading oil producer.

Other regional players, such as the United Arab Emirates, Qatar, and Oman, also have their own strategic interests and priorities. The complex web of alliances and rivalries in the region makes it difficult to find common ground and resolve disputes peacefully.

The Role of International Law:

The legal status of the Strait of Hormuz is also a matter of contention. Under international law, all ships have the right of innocent passage through international straits like the Strait of Hormuz. However, Iran argues that this right is not absolute and that it has the right to take measures to protect its security.

Iran has also asserted that it has the right to inspect vessels transiting the Strait to ensure that they are not carrying weapons or other contraband. These assertions have been rejected by the U.S. and other countries, which argue that they violate international law.

The Impact of Technology:

Technological advancements have also altered the dynamics in the Strait of Hormuz. The use of drones and sophisticated naval mines has made it easier to disrupt shipping and project power in the region. Cyberattacks are also a growing concern, as they could be used to target critical infrastructure, such as oil terminals and pipelines.

The proliferation of advanced weapons in the region has increased the risk of miscalculation and unintended escalation. A minor incident could quickly spiral into a full-blown conflict with devastating consequences.

Potential for De-escalation:

Despite the heightened tensions, there are still opportunities for de-escalation. Dialogue between the U.S. and Iran, perhaps facilitated by a third party, could help to reduce misunderstandings and build trust.

A return to the Iran nuclear deal, with some modifications, could also help to ease tensions. Such a deal would provide Iran with economic relief in exchange for verifiable limits on its nuclear program.

Regional cooperation is also essential. A forum for dialogue among the countries of the Persian Gulf could help to address underlying grievances and promote stability.

The Need for a Comprehensive Approach:

Addressing the situation in the Strait of Hormuz requires a comprehensive approach that takes into account the historical, economic, and geopolitical factors at play. A purely military solution is unlikely to be effective and could even exacerbate the problem.

Diplomacy, economic engagement, and regional cooperation are all essential elements of a sustainable solution. The international community must work together to ensure the security and stability of the Strait of Hormuz and prevent a conflict that could have catastrophic consequences for the global economy.

The Future of the Strait of Hormuz:

The future of the Strait of Hormuz remains uncertain. The region is likely to remain volatile for the foreseeable future, as long as tensions between the U.S. and Iran persist.

However, there is also the potential for positive change. A new generation of leaders in the region may be more willing to embrace dialogue and cooperation. The growing focus on renewable energy could also reduce the region’s dependence on oil and ease geopolitical tensions.

Ultimately, the future of the Strait of Hormuz will depend on the choices made by the countries of the region and the international community. A commitment to diplomacy, economic development, and regional cooperation is essential to ensure a peaceful and prosperous future for the Persian Gulf.