Global markets are on edge as escalating tensions in the Strait of Hormuz, a vital chokepoint for oil and gas shipments, raise concerns about potential disruptions to global trade and a possible surge in energy prices. Recent saber-rattling, following a U.S. attack (unspecified in the original article, but alluded to as a catalyst for increased tensions), has amplified fears that the waterway could be closed, though the likelihood of such an extreme measure remains uncertain.

The Strait of Hormuz, a narrow channel between Iran and Oman, is one of the world’s most strategically important waterways. It connects the oil-rich Persian Gulf to the Indian Ocean and serves as the primary export route for crude oil and liquefied natural gas (LNG) from major producers like Saudi Arabia, Iran, the United Arab Emirates, Kuwait, and Iraq. Disruption to traffic through the strait would have significant economic and geopolitical repercussions.

Economic Implications: A Delicate Balance

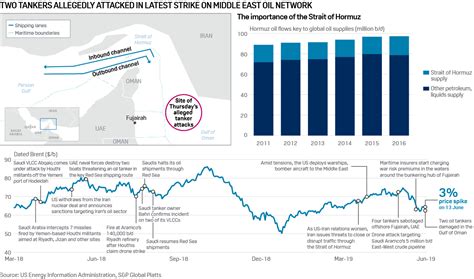

The potential closure of the Strait of Hormuz is not merely a regional concern; it’s a global economic threat. The waterway is responsible for the transit of a substantial percentage of the world’s oil supply. Estimates vary, but according to the U.S. Energy Information Administration (EIA), in 2018, around 21 million barrels per day (bpd) of crude oil and refined petroleum products transited the strait, representing approximately 21% of global petroleum liquids consumption. Although this figure fluctuates based on global demand and production levels, it underscores the strait’s critical role in the global energy market.

A closure, even temporary, could lead to a significant spike in oil prices. “Any disruption to the flow of oil through the Strait of Hormuz would have an immediate and significant impact on global oil prices,” states the original Yahoo Finance article. The extent of the price increase would depend on the duration of the closure, the availability of alternative supply routes, and the level of strategic petroleum reserves held by major consuming nations.

Beyond oil, the Strait of Hormuz is also a vital conduit for LNG exports. Qatar, one of the world’s largest LNG exporters, relies heavily on the strait to ship its gas to Asian and European markets. A disruption to LNG shipments would exacerbate energy shortages, particularly in countries heavily dependent on natural gas for power generation and heating.

The impact on global trade extends beyond energy. The Strait of Hormuz is a key shipping lane for a wide range of goods, including manufactured products, consumer goods, and raw materials. A closure would disrupt supply chains, increase shipping costs, and potentially lead to inflation. Industries reliant on just-in-time inventory management would be particularly vulnerable.

Geopolitical Considerations: A Region on Edge

The heightened tensions in the Strait of Hormuz are part of a broader geopolitical struggle in the Middle East. The rivalry between Iran and its regional adversaries, particularly Saudi Arabia, has fueled instability in the region for decades. The U.S. withdrawal from the Iran nuclear deal in 2018 and the subsequent reimposition of sanctions have further exacerbated tensions.

Iran has repeatedly threatened to close the Strait of Hormuz in response to perceived threats to its national security or its oil exports. While Iran has never fully closed the strait, it has engaged in provocative actions, such as seizing foreign-flagged vessels and conducting military exercises in the area, to demonstrate its ability to disrupt maritime traffic.

The U.S. Navy maintains a strong presence in the Persian Gulf and has vowed to keep the Strait of Hormuz open. However, a military confrontation between the U.S. and Iran could have unpredictable consequences and could potentially lead to a wider regional conflict.

The international community has a strong interest in maintaining the freedom of navigation in the Strait of Hormuz. A closure would not only harm the global economy but also undermine international law and the principle of freedom of the seas.

Alternative Routes and Mitigation Strategies

While the Strait of Hormuz is the most efficient route for oil and gas exports from the Persian Gulf, there are alternative routes, albeit with limitations.

- The East-West Pipeline (Petroline): Saudi Arabia operates the East-West Pipeline, which can transport crude oil from the eastern oil fields to the Red Sea port of Yanbu. From Yanbu, tankers can ship oil to Europe and North America via the Suez Canal. However, the pipeline’s capacity is limited, and it cannot fully compensate for the loss of exports through the Strait of Hormuz.

- The UAE Pipeline: The United Arab Emirates also has a pipeline that can transport crude oil from its eastern oil fields to the port of Fujairah on the Gulf of Oman, bypassing the Strait of Hormuz. However, like the Saudi pipeline, its capacity is limited.

- The Suez Canal: While the Suez Canal provides an alternative route to Europe and North America, it cannot accommodate Very Large Crude Carriers (VLCCs), which are the largest oil tankers. This means that oil would have to be transferred to smaller vessels, increasing shipping costs and reducing efficiency.

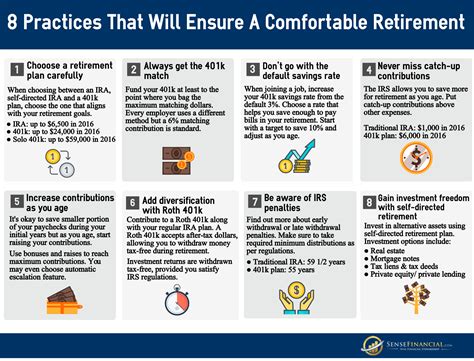

Major oil-consuming nations also maintain strategic petroleum reserves (SPRs) to cushion the impact of supply disruptions. The United States, for example, has the world’s largest SPR, with a capacity of over 700 million barrels. However, releasing SPRs is only a temporary solution and cannot fully offset a prolonged closure of the Strait of Hormuz.

The Likelihood of Closure: A Matter of Debate

Despite the heightened tensions, the likelihood of a complete and sustained closure of the Strait of Hormuz remains uncertain. Iran recognizes that closing the strait would not only harm its own economy but also alienate its trading partners and invite international condemnation.

“Whether the key waterway will close is less clear,” the Yahoo Finance article notes. While Iran may engage in provocative actions to signal its displeasure and exert pressure on its adversaries, it is unlikely to take the drastic step of completely shutting down the strait unless it feels its survival is at stake.

However, miscalculations and unintended escalation are always a risk in such a volatile region. A minor incident, such as a collision between a U.S. Navy vessel and an Iranian patrol boat, could quickly spiral out of control and lead to a wider conflict.

Conclusion: Navigating Uncertainty

The Strait of Hormuz remains a critical chokepoint for global energy supplies and trade. The escalating tensions in the region pose a significant threat to the stability of the global economy. While the likelihood of a complete closure of the strait remains uncertain, the potential consequences are too serious to ignore.

Governments and businesses need to prepare for the possibility of disruptions to maritime traffic through the Strait of Hormuz. This includes diversifying energy sources, developing alternative supply routes, and building up strategic reserves. International cooperation is also essential to de-escalate tensions and ensure the freedom of navigation in this vital waterway.

Historical Context and Previous Incidents

The Strait of Hormuz has a long history of geopolitical tension. During the Iran-Iraq War in the 1980s, both sides attacked tankers in the Persian Gulf in an effort to disrupt the other’s oil exports. This period, known as the “Tanker War,” saw numerous vessels damaged or destroyed.

In 1988, the U.S. Navy shot down an Iranian passenger plane over the Persian Gulf, killing all 290 people on board. The U.S. claimed that the plane was mistakenly identified as an Iranian fighter jet. The incident further strained relations between the U.S. and Iran.

In recent years, there have been several incidents involving the seizure of foreign-flagged vessels by Iran in the Strait of Hormuz. In 2019, Iran seized a British-flagged tanker in retaliation for the seizure of an Iranian tanker by British authorities in Gibraltar. These incidents highlight the vulnerability of maritime traffic in the strait and the potential for miscalculations and escalation.

The Role of International Law

The Strait of Hormuz is subject to international law, which guarantees the right of innocent passage for all ships. However, the interpretation of “innocent passage” is often contested. Iran argues that foreign warships must obtain its permission before transiting the strait, while the U.S. and other countries maintain that they have the right to transit the strait without prior notification.

The United Nations Convention on the Law of the Sea (UNCLOS) provides a framework for resolving disputes over maritime rights and obligations. However, the U.S. has not ratified UNCLOS, which weakens its ability to challenge Iran’s actions in the Strait of Hormuz under international law.

Technological Advancements and Alternative Energy Sources

While the Strait of Hormuz remains strategically important, technological advancements and the development of alternative energy sources are gradually reducing its significance.

- Increased U.S. Oil Production: The shale revolution in the United States has transformed the country from a major oil importer to a major oil producer. This has reduced U.S. dependence on oil imports from the Persian Gulf.

- Renewable Energy Sources: The growing adoption of renewable energy sources, such as solar and wind power, is also reducing global reliance on fossil fuels.

- Electric Vehicles: The increasing popularity of electric vehicles is expected to reduce demand for gasoline and diesel in the long term.

However, these trends are unlikely to eliminate the strategic importance of the Strait of Hormuz in the near future. Oil and gas will continue to play a major role in the global energy mix for decades to come.

Insurance and Shipping Costs

The increased tensions in the Strait of Hormuz have led to higher insurance premiums for ships transiting the waterway. War risk insurance rates have risen significantly, adding to the cost of shipping oil and other goods.

Some shipping companies have also rerouted their vessels to avoid the Strait of Hormuz, adding to transit times and costs. This is particularly true for companies that are concerned about the safety of their crews and vessels.

Impact on Asian Economies

Asian economies, particularly those in East Asia, are heavily reliant on oil and gas imports from the Persian Gulf. A closure of the Strait of Hormuz would have a significant impact on their economies, potentially leading to energy shortages, inflation, and slower economic growth.

Countries like China, Japan, South Korea, and India are particularly vulnerable. They have been diversifying their energy sources and building up strategic reserves to mitigate the impact of potential disruptions to supply.

Diplomatic Efforts and Regional Security Initiatives

Several diplomatic efforts and regional security initiatives are underway to de-escalate tensions in the Persian Gulf and ensure the freedom of navigation in the Strait of Hormuz.

- The Joint Comprehensive Plan of Action (JCPOA): The JCPOA, also known as the Iran nuclear deal, was aimed at preventing Iran from developing nuclear weapons in exchange for the lifting of sanctions. The U.S. withdrawal from the JCPOA has undermined the agreement and increased tensions in the region. Efforts are underway to revive the JCPOA.

- The International Maritime Security Construct (IMSC): The IMSC is a multinational naval coalition that aims to protect commercial shipping in the Persian Gulf, the Strait of Hormuz, and the Gulf of Oman. The coalition is led by the United States and includes several other countries, such as the United Kingdom, Australia, and Saudi Arabia.

- Regional Dialogue Initiatives: Several regional dialogue initiatives are aimed at promoting cooperation and reducing tensions between Iran and its neighbors. These initiatives are often facilitated by third-party countries, such as Oman and Kuwait.

The Future of the Strait of Hormuz: Scenarios and Outlook

The future of the Strait of Hormuz is uncertain. Several scenarios are possible:

- Continued Tensions: Tensions could remain high, with periodic incidents and provocations, but without a major conflict. This scenario would likely result in continued uncertainty and higher shipping costs.

- Escalation to Conflict: A miscalculation or unintended escalation could lead to a military confrontation between the U.S. and Iran, or between Iran and its regional adversaries. This scenario would have devastating consequences for the region and the global economy.

- De-escalation and Dialogue: Diplomatic efforts could succeed in de-escalating tensions and promoting cooperation. This scenario would require a willingness from all parties to compromise and address the underlying causes of conflict.

The outlook for the Strait of Hormuz will depend on a number of factors, including the policies of the U.S. and Iran, the dynamics of regional rivalries, and the state of the global economy. Prudent risk management and diversification strategies remain critical for all stakeholders.

Frequently Asked Questions (FAQ)

-

How important is the Strait of Hormuz to the global oil supply? The Strait of Hormuz is exceptionally vital; it serves as the passage for approximately 21% of the world’s total petroleum liquids consumption, making it a critical artery for global energy markets. Disruptions here can have immediate and substantial price repercussions worldwide.

-

What are the potential consequences of the Strait of Hormuz being closed? Closure would significantly impact global trade and energy markets, leading to increased oil prices, supply chain disruptions, and potential inflation. Countries reliant on the strait for oil and LNG imports would face shortages and economic challenges.

-

Has Iran closed the Strait of Hormuz before? While Iran has never fully closed the strait for an extended period, it has engaged in provocative actions, such as seizing foreign vessels and conducting military exercises, to demonstrate its ability to disrupt maritime traffic.

-

Are there alternative routes to bypass the Strait of Hormuz? Yes, alternative routes exist, including the East-West Pipeline in Saudi Arabia and the UAE Pipeline, but their capacity is limited and cannot fully compensate for the loss of exports through the Strait of Hormuz. The Suez Canal is another alternative but cannot accommodate very large crude carriers (VLCCs).

-

What is the international community doing to ensure the Strait of Hormuz remains open? The international community, including the U.S. Navy, maintains a presence in the Persian Gulf to ensure freedom of navigation. Diplomatic efforts and regional security initiatives, such as the International Maritime Security Construct (IMSC) and attempts to revive the JCPOA, also aim to de-escalate tensions and promote stability.