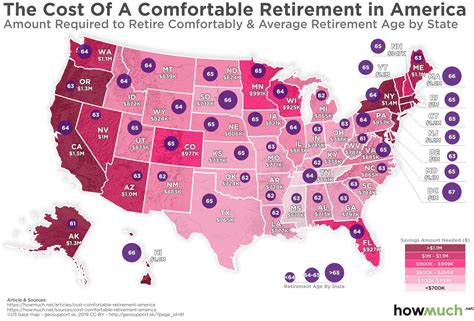

Retirement remains a distant dream for the vast majority of Americans, with a staggering 97% still falling short of the savings needed to retire comfortably, according to a new analysis. Despite evolving retirement planning guidelines suggesting individuals should aim to accumulate ten to twelve times their final salary by retirement, most Americans are nowhere near that goal, continuing a persistent struggle against rising costs and stagnant wages.

The sobering reality underscores a deep-seated financial insecurity plaguing American workers, highlighting the urgent need for improved retirement planning strategies and potentially, systemic changes to address the growing retirement crisis. Fidelity Investments, a leading retirement plan provider, recently updated its retirement savings recommendations, suggesting that workers should save at least 15% of their income, including any employer match, throughout their careers. However, many Americans struggle to meet even basic savings targets, let alone these more ambitious goals.

The challenges are multifaceted, stemming from factors such as insufficient wages, mounting debt, and a lack of access to affordable financial advice. Social Security, while a crucial safety net, is not designed to be the sole source of retirement income for most individuals. Therefore, personal savings and employer-sponsored retirement plans, such as 401(k)s, play a critical role in ensuring a financially secure retirement.

The Widening Retirement Savings Gap

The gap between what Americans have saved and what they need to retire comfortably continues to widen, creating a significant challenge for individuals approaching retirement age. Several factors contribute to this persistent shortfall, including inadequate savings rates, investment choices, and the rising cost of healthcare.

“Many Americans are simply not saving enough to maintain their current lifestyle in retirement,” says a financial advisor. “The combination of longer lifespans and increasing healthcare costs puts a tremendous strain on retirement savings.”

Data from various studies consistently show that a significant portion of Americans are behind on their retirement savings goals. According to the Employee Benefit Research Institute (EBRI), a substantial percentage of households are at risk of not having enough money to cover their basic retirement expenses. This risk is particularly acute for lower-income individuals and those who have not had access to employer-sponsored retirement plans.

Impact of Inflation and Economic Uncertainty

Inflation and economic uncertainty further exacerbate the retirement savings challenge. The rising cost of goods and services erodes the purchasing power of savings, making it more difficult for retirees to maintain their standard of living. The recent surge in inflation has particularly affected essential expenses such as food, housing, and healthcare, placing additional pressure on retirees and those nearing retirement.

The Federal Reserve’s efforts to combat inflation by raising interest rates have also had an impact on retirement savings. While higher interest rates can benefit savers in the long run, they can also lead to market volatility and reduced returns on investments in the short term. This uncertainty makes it even more challenging for individuals to plan for retirement with confidence.

Social Security’s Role and Limitations

Social Security remains a vital source of retirement income for millions of Americans, but it is not designed to be a complete replacement for pre-retirement earnings. The average Social Security benefit is often insufficient to cover all of a retiree’s expenses, particularly for those with higher living costs.

Furthermore, the long-term solvency of Social Security is a growing concern. Demographic trends, such as declining birth rates and increasing lifespans, are putting pressure on the Social Security system. Without reforms, Social Security may not be able to pay full benefits in the future, which would further jeopardize the financial security of retirees.

Employer-Sponsored Retirement Plans: 401(k)s and Beyond

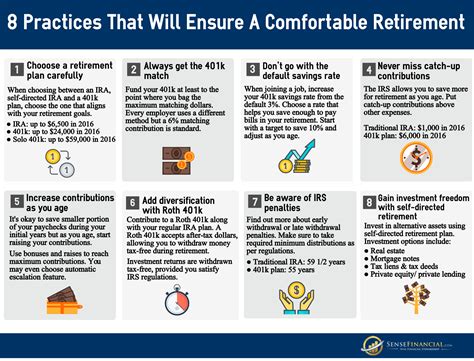

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, are crucial tools for building retirement savings. These plans offer several advantages, including tax-deferred growth and the potential for employer matching contributions. However, participation rates in these plans vary widely, and many workers do not take full advantage of the available benefits.

One common challenge is that employees often fail to contribute enough to their 401(k)s to maximize employer matching contributions. This is a missed opportunity, as employer matches can significantly boost retirement savings over time. Additionally, some workers may not understand the investment options available in their 401(k) plans and may make suboptimal investment choices.

Strategies for Improving Retirement Readiness

Despite the challenges, there are several strategies that individuals can use to improve their retirement readiness. These include:

- Increasing Savings Rates: Aim to save at least 15% of your income for retirement, including any employer match.

- Taking Advantage of Employer Matching Contributions: Always contribute enough to your 401(k) to maximize employer matching contributions.

- Investing Wisely: Diversify your investments and consider consulting with a financial advisor to develop a personalized investment strategy.

- Reducing Debt: High levels of debt can significantly impact your ability to save for retirement. Prioritize paying down high-interest debt.

- Delaying Retirement: Working a few extra years can significantly boost your retirement savings and reduce the number of years you need to draw on your savings.

- Seeking Financial Advice: A qualified financial advisor can help you assess your retirement needs and develop a plan to achieve your goals.

- Understanding Social Security: Familiarize yourself with Social Security benefits and eligibility requirements.

- Planning for Healthcare Costs: Healthcare expenses can be a significant drain on retirement savings. Plan ahead and consider purchasing supplemental health insurance.

- Downsizing: Consider downsizing your home or relocating to a more affordable area to reduce your living expenses in retirement.

- Creating a Budget: Develop a budget to track your income and expenses and identify areas where you can save more.

The Role of Financial Literacy

Financial literacy plays a crucial role in retirement planning. Individuals who understand basic financial concepts, such as budgeting, saving, and investing, are more likely to make informed decisions about their retirement savings. Unfortunately, financial literacy levels are relatively low in the United States, particularly among younger generations.

“Many young adults lack the basic financial knowledge needed to make sound decisions about their finances,” says a financial literacy expert. “This lack of knowledge can lead to poor saving habits and ultimately jeopardize their retirement security.”

Efforts to improve financial literacy are essential for addressing the retirement savings crisis. Schools, employers, and community organizations can play a role in providing financial education to individuals of all ages.

Government Policies and Retirement Security

Government policies can also play a significant role in promoting retirement security. Policies that encourage savings, such as tax incentives for retirement contributions, can help individuals build larger retirement nest eggs. Additionally, policies that protect Social Security and ensure its long-term solvency are crucial for providing a safety net for retirees.

Some policy proposals aimed at improving retirement security include:

- Expanding access to retirement plans: Making it easier for small businesses to offer retirement plans to their employees.

- Increasing the Social Security retirement age: Gradually raising the age at which individuals can claim Social Security benefits.

- Adjusting the Social Security benefit formula: Modifying the formula used to calculate Social Security benefits to ensure the system’s long-term solvency.

- Providing financial education: Implementing financial literacy programs in schools and communities.

The Psychological Impact of Retirement Insecurity

Retirement insecurity can have a significant psychological impact on individuals, leading to stress, anxiety, and depression. The fear of running out of money in retirement can be a constant source of worry, affecting mental and emotional well-being.

“Retirement should be a time of relaxation and enjoyment, but for many Americans, it is a time of fear and uncertainty,” says a psychologist. “The stress of retirement insecurity can have a devastating impact on their mental health.”

Addressing the retirement savings crisis is not only a financial imperative but also a matter of public health. Providing individuals with the resources and support they need to achieve retirement security can improve their overall well-being and quality of life.

Conclusion: A Call to Action

The retirement savings crisis is a complex issue with no easy solutions. However, by taking proactive steps to improve their financial literacy, increase their savings rates, and plan for their retirement needs, individuals can increase their chances of achieving a financially secure retirement. Additionally, government policies and employer initiatives can play a vital role in supporting retirement security. It requires a concerted effort from individuals, employers, and policymakers to address this growing challenge and ensure that all Americans have the opportunity to retire with dignity and security. The latest data serves as a stark reminder of the urgent need for action. “The numbers paint a clear picture: we need to fundamentally rethink how we approach retirement savings in this country,” says a senior economist. “Waiting is no longer an option.”

The challenge remains significant: “As highlighted in recent analyses, a substantial percentage of Americans are not on track to achieve a comfortable retirement, emphasizing the need for proactive financial planning and increased savings efforts.” This concerning statistic underscores the importance of taking immediate action to address the widening retirement savings gap and secure a financially stable future.

Frequently Asked Questions (FAQ)

1. Why are so many Americans struggling to save enough for retirement?

Several factors contribute to the retirement savings gap, including stagnant wages, rising costs of living (especially healthcare), insufficient savings rates, high levels of debt, and a lack of access to employer-sponsored retirement plans or financial advice. The complexity of financial planning and the psychological barriers to saving, such as prioritizing immediate needs over long-term goals, also play a role. As the article highlights, “Many Americans are simply not saving enough to maintain their current lifestyle in retirement,” a sentiment echoed by financial advisors nationwide.

2. What is the recommended savings target for a comfortable retirement?

While guidelines vary, a common recommendation is to accumulate ten to twelve times your final salary by retirement. Fidelity Investments suggests aiming to save at least 15% of your income, including any employer match, throughout your career. However, the ideal amount depends on individual circumstances, including lifestyle, healthcare costs, and retirement goals. A financial advisor can help you determine a personalized savings target.

3. How does Social Security fit into retirement planning?

Social Security is a crucial safety net but is not designed to be the sole source of retirement income. The average Social Security benefit is often insufficient to cover all of a retiree’s expenses. Furthermore, the long-term solvency of Social Security is a concern. Personal savings and employer-sponsored retirement plans are essential for supplementing Social Security benefits.

4. What are the key benefits of participating in a 401(k) plan?

401(k) plans offer several advantages, including tax-deferred growth, the potential for employer matching contributions, and the convenience of automatic payroll deductions. Employer matches can significantly boost retirement savings over time. It’s crucial to contribute enough to your 401(k) to maximize employer matching contributions.

5. What steps can I take to improve my retirement readiness if I’m behind on savings?

Several strategies can help you catch up on retirement savings:

- Increase your savings rate: Even a small increase in your savings rate can make a big difference over time.

- Take advantage of employer matching contributions: Always contribute enough to your 401(k) to maximize employer matching contributions.

- Reduce debt: High levels of debt can significantly impact your ability to save for retirement.

- Delay retirement: Working a few extra years can significantly boost your retirement savings.

- Seek financial advice: A qualified financial advisor can help you assess your retirement needs and develop a plan to achieve your goals. As the article suggests, “planning for healthcare costs” is also crucial, as these expenses can significantly impact retirement savings.

Expanded Analysis and Context

The news that 97% of Americans are not on track for a comfortable retirement is not simply a statistic; it represents a systemic issue with deep roots in the American economy and societal structures. To fully understand the implications, it’s necessary to delve into the multifaceted causes and explore potential solutions beyond individual financial planning.

The Erosion of Real Wages and the Rise of Precarious Work

One of the fundamental challenges is the long-term stagnation of real wages. While productivity has increased significantly over the past few decades, wages for the majority of American workers have not kept pace. This means that even with diligent saving, many individuals simply do not have enough disposable income to adequately fund their retirement accounts.

Adding to this challenge is the rise of precarious work arrangements, such as the gig economy and contract labor. These types of employment often lack traditional benefits like employer-sponsored retirement plans and health insurance, leaving workers to shoulder the entire burden of saving for retirement on their own. The instability and unpredictability of income in these roles also make it difficult to plan for the future and consistently contribute to retirement savings.

The Impact of Student Loan Debt and Other Financial Burdens

The burden of student loan debt is another significant obstacle to retirement savings, particularly for younger generations. Millions of Americans are saddled with tens of thousands of dollars in student loans, which can take decades to repay. This debt consumes a significant portion of their income, leaving little room for saving for retirement or other long-term goals.

Beyond student loans, many Americans are also struggling with other forms of debt, such as credit card debt, medical debt, and auto loans. These financial burdens further strain their budgets and make it even more difficult to save for retirement. The rising cost of housing, childcare, and other essential expenses also contributes to the financial pressures facing many households.

The Decline of Defined Benefit Pensions and the Shift to Defined Contribution Plans

The shift from defined benefit (DB) pensions to defined contribution (DC) plans, such as 401(k)s, has also had a significant impact on retirement security. DB pensions guaranteed a certain level of income in retirement, based on years of service and salary. In contrast, DC plans require individuals to manage their own investments and bear the risk of market fluctuations.

While DC plans offer more flexibility and portability, they also place a greater burden on individuals to make informed investment decisions and manage their retirement savings effectively. Many Americans lack the financial literacy and investment expertise needed to navigate the complexities of DC plans, leading to suboptimal investment choices and inadequate retirement savings.

The Role of Behavioral Economics in Retirement Planning

Behavioral economics provides valuable insights into the psychological factors that influence retirement saving behavior. Studies have shown that individuals are often prone to procrastination, present bias, and other cognitive biases that can hinder their ability to save for retirement. For example, many people tend to delay saving for retirement until they are older, missing out on the benefits of compounding interest over time.

Automatic enrollment in 401(k) plans and automatic escalation of contribution rates are two behavioral interventions that have been shown to be effective in increasing retirement savings. These interventions leverage the power of defaults and inertia to encourage individuals to save more for retirement.

Addressing Systemic Inequalities in Retirement Security

The retirement savings crisis disproportionately affects certain demographic groups, including women, minorities, and low-income individuals. These groups often face systemic barriers to wealth accumulation, such as wage discrimination, limited access to education and job opportunities, and a lack of financial resources.

Addressing these systemic inequalities is essential for promoting retirement security for all Americans. Policies that promote equal pay, expand access to affordable healthcare and childcare, and provide financial education to underserved communities can help to level the playing field and ensure that everyone has the opportunity to achieve a financially secure retirement.

The Need for Comprehensive Retirement Reform

Addressing the retirement savings crisis requires a comprehensive approach that includes individual responsibility, employer initiatives, and government policies. Individuals need to take proactive steps to improve their financial literacy, increase their savings rates, and plan for their retirement needs. Employers can play a role by offering robust retirement plans, providing financial education to their employees, and promoting a culture of saving.

Government policies can also play a vital role in promoting retirement security. Policies that encourage savings, protect Social Security, and address systemic inequalities can help to ensure that all Americans have the opportunity to retire with dignity and security. Some specific policy proposals that could help to improve retirement security include:

- Expanding Social Security: Increasing Social Security benefits and ensuring the system’s long-term solvency.

- Creating a universal retirement savings system: Establishing a government-sponsored retirement savings plan that is available to all workers, regardless of their employment status.

- Providing tax credits for retirement contributions: Offering tax credits to encourage individuals to save for retirement.

- Strengthening consumer protections: Protecting consumers from predatory financial practices that can erode their retirement savings.

- Investing in financial education: Providing financial education to individuals of all ages.

Examples of Success Stories and Innovative Solutions

While the overall picture of retirement savings in America is concerning, there are also examples of success stories and innovative solutions that offer hope for the future. Some employers are implementing innovative retirement savings programs, such as auto-enrollment with auto-escalation and matching contributions beyond the traditional 401(k) model. These programs have been shown to significantly increase employee participation and savings rates.

Some states are also experimenting with innovative retirement savings programs, such as state-sponsored retirement plans for private-sector workers who do not have access to employer-sponsored plans. These programs can help to expand access to retirement savings opportunities for millions of Americans.

The Importance of Long-Term Planning and Adaptability

Retirement planning is not a one-time event; it is an ongoing process that requires long-term planning and adaptability. Individuals need to regularly review their retirement savings and adjust their plans as needed to account for changes in their circumstances, such as job loss, health issues, or changes in family needs.

It is also important to be adaptable and willing to adjust retirement plans in response to changing economic conditions. For example, if interest rates rise, it may be beneficial to shift some of your investments into bonds or other fixed-income assets. If inflation increases, it may be necessary to increase your savings rate or delay retirement.

The Psychological Benefits of Planning for Retirement

Planning for retirement is not only a financial imperative; it also has significant psychological benefits. Having a plan for retirement can reduce stress and anxiety, increase feelings of control, and provide a sense of purpose and direction. Knowing that you are taking steps to secure your financial future can improve your overall well-being and quality of life.

A Call for Collective Action and Systemic Change

The retirement savings crisis is a complex issue that requires collective action and systemic change. Individuals, employers, and policymakers all have a role to play in addressing this challenge and ensuring that all Americans have the opportunity to retire with dignity and security.

It is time for a renewed commitment to retirement security in America. By working together, we can create a future where all Americans can look forward to a comfortable and fulfilling retirement. The latest statistics should serve as a wake-up call to everyone involved. The time to act is now.