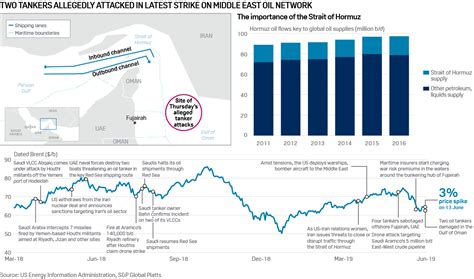

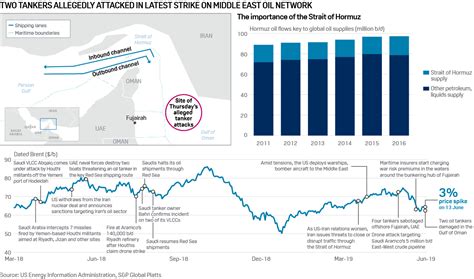

Oil prices surged and concerns about global trade disruptions intensified following heightened tensions surrounding the Strait of Hormuz, a vital chokepoint for global oil supplies, in the wake of a recent U.S. attack. While saber-rattling has increased, whether the key waterway will actually close remains uncertain, creating a volatile situation for energy markets and international commerce.

The Strait of Hormuz, a narrow channel between Oman and Iran, is one of the world’s most strategically important waterways. Approximately 21 million barrels of crude oil pass through the strait daily, representing about 21% of global petroleum liquids consumption. Any disruption to this flow could have significant consequences for the global economy.

Recent escalations have fueled fears of a potential closure. According to Yahoo Finance, “geopolitical tensions are escalating,” with concerns arising from a recent U.S. military action that has prompted strong reactions from Iran. This has led to increased rhetoric and military posturing, raising the specter of a confrontation that could impact shipping in the region.

“The market is very sensitive to any news that suggests a potential disruption to oil supplies from the Middle East,” said an analyst. The mere possibility of a closure is enough to trigger price volatility, as traders factor in the risk of reduced supply.

The closure of the Strait of Hormuz, even temporarily, could lead to a sharp spike in oil prices. This would have a ripple effect across the global economy, impacting transportation costs, manufacturing, and consumer spending. Furthermore, it could exacerbate inflationary pressures, which are already a concern in many countries.

Beyond the immediate impact on oil prices, a closure could also disrupt global trade flows. The Strait of Hormuz is a key transit route for goods traveling between Asia and Europe, and any interruption could lead to delays and increased shipping costs. This would affect a wide range of industries, from manufacturing to retail.

The potential consequences of a Strait of Hormuz closure are far-reaching, highlighting the importance of de-escalation and diplomatic efforts to maintain stability in the region.

Heightened Tensions and Saber-Rattling

The recent increase in tensions can be attributed to a complex interplay of factors, including long-standing geopolitical rivalries, nuclear proliferation concerns, and regional conflicts. The U.S. withdrawal from the Iran nuclear deal in 2018 and the subsequent reimposition of sanctions have further strained relations between the two countries.

In response to the sanctions, Iran has threatened to close the Strait of Hormuz on several occasions. While these threats have not been carried out, they serve as a reminder of the potential for disruption.

The increased military presence in the region by both the U.S. and Iran has also contributed to the heightened tensions. This has created a climate of mistrust and suspicion, increasing the risk of miscalculation and accidental conflict.

“The situation is very volatile, and there is a risk of escalation,” said a geopolitical analyst. “Both sides need to exercise restraint and avoid any actions that could further inflame tensions.”

Impact on Oil Prices

The Strait of Hormuz is a critical chokepoint for global oil supplies, and any disruption to this flow could have a significant impact on oil prices. According to data, approximately 21 million barrels of crude oil pass through the strait daily, representing about 21% of global petroleum liquids consumption.

A closure of the Strait of Hormuz could lead to a sharp spike in oil prices, potentially exceeding $150 or even $200 per barrel, depending on the duration of the closure and the availability of alternative supply routes. This would have a ripple effect across the global economy, impacting transportation costs, manufacturing, and consumer spending.

“The oil market is very sensitive to geopolitical risks, and any disruption to supply could lead to a significant price increase,” said an energy economist. “Consumers would feel the pain at the pump, and businesses would face higher energy costs.”

The impact on oil prices would also depend on the response of other oil-producing countries. If Saudi Arabia and other OPEC members were able to increase production to offset the loss of Iranian oil, the price impact could be mitigated. However, there is no guarantee that this would happen, and even if it did, it would take time to ramp up production.

Global Trade Disruptions

Beyond the immediate impact on oil prices, a closure of the Strait of Hormuz could also disrupt global trade flows. The strait is a key transit route for goods traveling between Asia and Europe, and any interruption could lead to delays and increased shipping costs.

This would affect a wide range of industries, from manufacturing to retail. Companies that rely on just-in-time inventory management would be particularly vulnerable, as they would not have sufficient stockpiles to weather a prolonged disruption.

“A closure of the Strait of Hormuz would be a major shock to the global economy,” said a trade expert. “It would disrupt supply chains, increase costs, and potentially lead to a slowdown in economic growth.”

The impact on global trade would also depend on the availability of alternative shipping routes. While some goods could be rerouted through the Suez Canal or around the Cape of Good Hope, these routes are longer and more expensive, adding to the overall cost of trade.

Potential Scenarios and Responses

There are several possible scenarios that could unfold in the coming weeks and months. One possibility is that tensions will continue to simmer, with occasional incidents and provocations, but without leading to a full-blown conflict. In this scenario, oil prices would likely remain volatile, but the Strait of Hormuz would remain open.

Another possibility is that a miscalculation or accidental incident could trigger a wider conflict. This could lead to a temporary or prolonged closure of the Strait of Hormuz, with significant consequences for the global economy.

A third possibility is that diplomatic efforts will succeed in de-escalating tensions and restoring stability to the region. This would require both the U.S. and Iran to show restraint and engage in meaningful dialogue.

In response to the heightened tensions, several countries have taken steps to protect their interests. The U.S. has increased its military presence in the region, while other countries have called for de-escalation and diplomatic solutions.

The International Energy Agency (IEA) has also stated that it is prepared to release emergency oil stocks if necessary to mitigate the impact of any supply disruptions.

Historical Precedents

The Strait of Hormuz has been the site of several incidents in the past, highlighting its strategic importance and vulnerability. During the Iran-Iraq War in the 1980s, both sides attacked tankers in the strait, leading to a period known as the “Tanker War.”

In 1988, the U.S. Navy shot down an Iranian passenger plane over the strait, killing 290 people. The U.S. claimed that the plane was mistaken for a fighter jet, but Iran has always maintained that the shooting was deliberate.

In recent years, there have been several incidents involving Iranian forces and foreign tankers in the strait, including the seizure of a British-flagged tanker in 2019.

These historical precedents underscore the potential for conflict in the Strait of Hormuz and the importance of maintaining stability in the region.

Geopolitical Implications

The situation in the Strait of Hormuz has significant geopolitical implications, extending beyond the immediate impact on oil prices and global trade. The region is a key battleground in the ongoing rivalry between the U.S. and Iran, and any escalation could have far-reaching consequences for the balance of power in the Middle East.

The crisis also highlights the vulnerability of global supply chains to geopolitical risks. As the world becomes increasingly interconnected, disruptions in one region can have a significant impact on the global economy.

The situation in the Strait of Hormuz underscores the importance of international cooperation and diplomacy in maintaining stability and preventing conflict. It also highlights the need for countries to diversify their energy sources and reduce their dependence on vulnerable chokepoints.

Expert Opinions and Analysis

Experts are divided on the likelihood of a full-scale closure of the Strait of Hormuz. Some believe that Iran would be unlikely to take such a drastic step, as it would harm its own economy and invite a strong response from the U.S. and other countries.

Others argue that Iran may be willing to take such a risk if it feels that its vital interests are threatened. They point to Iran’s history of provocative behavior and its willingness to use asymmetric warfare tactics.

“It’s a very difficult situation to predict,” said a security analyst. “There are a lot of unknowns, and the risk of miscalculation is high.”

Most experts agree that the situation in the Strait of Hormuz is likely to remain volatile for the foreseeable future, and that businesses and consumers should be prepared for potential disruptions to oil supplies and global trade.

Alternative Routes and Mitigation Strategies

While the Strait of Hormuz is the most critical chokepoint for oil transport, several alternative routes and mitigation strategies exist, although they come with their own limitations and costs.

- The East-West Pipeline (Petroline): This pipeline runs across Saudi Arabia, connecting its oil fields in the east to the Red Sea in the west. It has a capacity of about 5 million barrels per day. While a valuable alternative, it cannot fully replace the volume that passes through the Strait of Hormuz.

- The Abu Dhabi Crude Oil Pipeline (ADCOP): This pipeline transports oil from Abu Dhabi to Fujairah on the Gulf of Oman, bypassing the Strait of Hormuz. Its capacity is around 1.5 million barrels per day.

- Increasing Production Elsewhere: Other oil-producing nations, such as Saudi Arabia, the United Arab Emirates, and the United States, could increase their production to offset any potential losses. However, there are limits to how quickly and significantly these nations can ramp up production.

- Strategic Petroleum Reserves (SPR): Countries like the United States, Japan, and Germany maintain strategic petroleum reserves that can be released in times of crisis to stabilize the market and provide a buffer against supply disruptions.

- Diversifying Energy Sources: In the long term, reducing dependence on oil by investing in renewable energy sources like solar, wind, and hydro can help mitigate the impact of potential disruptions in oil supply.

However, it is crucial to recognize that none of these alternatives can entirely compensate for a prolonged closure of the Strait of Hormuz. The global economy would still experience significant challenges, including higher energy prices and supply chain disruptions.

The Role of International Diplomacy

Given the potential consequences of a conflict in the Strait of Hormuz, international diplomacy plays a crucial role in de-escalating tensions and ensuring stability. Key actors include:

- The United Nations: The UN can serve as a forum for dialogue and negotiation between the involved parties. The UN Security Council can also pass resolutions to address the crisis and enforce international law.

- The European Union: The EU has a strong interest in maintaining stability in the Middle East and ensuring the free flow of trade. The EU can use its diplomatic and economic influence to encourage de-escalation and promote dialogue.

- Regional Powers: Countries like Oman, Qatar, and Kuwait can play a mediating role due to their relationships with both Iran and the U.S. Their diplomatic efforts can help bridge the gap between the two sides and find common ground.

Effective diplomacy requires open communication channels, a willingness to compromise, and a focus on finding solutions that address the legitimate concerns of all parties involved. It also requires a commitment to international law and the peaceful resolution of disputes.

FAQ: Strait of Hormuz Closure and Oil Price Impacts

1. What is the Strait of Hormuz and why is it important?

The Strait of Hormuz is a narrow waterway between Oman and Iran connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea. It is a vital strategic chokepoint through which approximately 21% of the world’s petroleum liquids consumption passes daily, making it crucial for global energy supplies and trade.

2. What are the potential impacts of a Strait of Hormuz closure on oil prices?

A closure could cause a significant spike in oil prices, potentially exceeding $150 or even $200 per barrel, depending on the duration of the closure and the availability of alternative supply routes. This would increase transportation costs, manufacturing expenses, and consumer prices globally, potentially leading to inflation.

3. What factors could lead to the closure of the Strait of Hormuz?

Escalating geopolitical tensions between Iran and the United States, military conflicts, or deliberate acts of aggression could lead to the closure. Iran has threatened to close the strait in response to sanctions and perceived threats to its national interests.

4. What are some alternative routes or strategies to mitigate the impact of a closure?

Alternatives include using the East-West Pipeline (Petroline) in Saudi Arabia, the Abu Dhabi Crude Oil Pipeline (ADCOP), increasing oil production in other countries, releasing strategic petroleum reserves, and diversifying energy sources by investing in renewables. However, these alternatives cannot fully compensate for a prolonged closure.

5. What role does international diplomacy play in addressing the situation in the Strait of Hormuz?

International diplomacy is crucial for de-escalating tensions and ensuring stability. The United Nations, the European Union, and regional powers like Oman and Qatar can facilitate dialogue between the U.S. and Iran, promote peaceful resolutions, and enforce international law to prevent conflicts and ensure safe passage through the strait.